Program Overview

MCC’s $395.3 million Georgia Compact (2006-2011) funded the $20 million Agribusiness Development Activity (ADA), which was designed to accelerate the shift from subsistence to commercial agriculture. The ADA awarded 283 grants in amounts ranging from $5,000 to $300,000 to groups of farmers and enterprises motivated to apply innovative business solutions and technology. The activity was based on the theory that providing monetary resources would improve agribusiness productivity and efficiency, thereby increasing revenues and decreasing production costs.

Evaluator Description

MCC commissioned NORC at the University of Chicago to conduct an independent final performance evaluation of the ADA. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/106.

Key Findings

Investment and Access to Credit

- Grantees used their grants to increase their agricultural equipment and machinery investments.

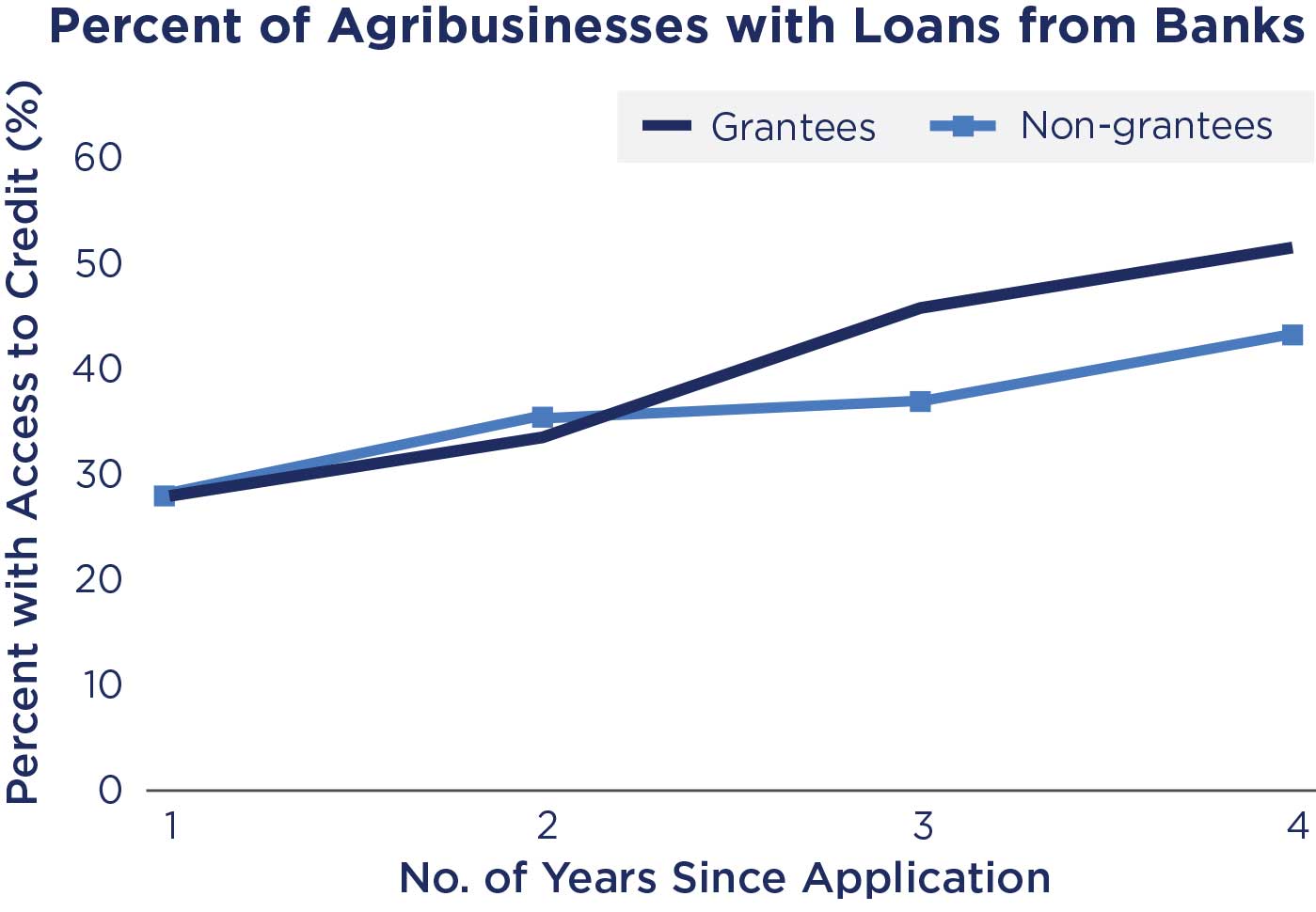

- Access to credit increased substantially after the grant application opened. Four years later, the number of respondents with bank loans increased for both grantee and non-grantee respondents, with grantees showing an increase of 10 percentage points over non-grantees. Non-grantees refers to applicants, but not recipients of a grant.

Production and Profit

- The majority of grantees and non-grantees reported increases in production levels and profits.

- Grantees frequently indicated technological improvements as the main driver of growth, while non-grantees cited increases in the scale of their operations.

- Grantees did not experience larger increases in profits relative to non-grantees in the years after receiving the grant.

Employment and Wages

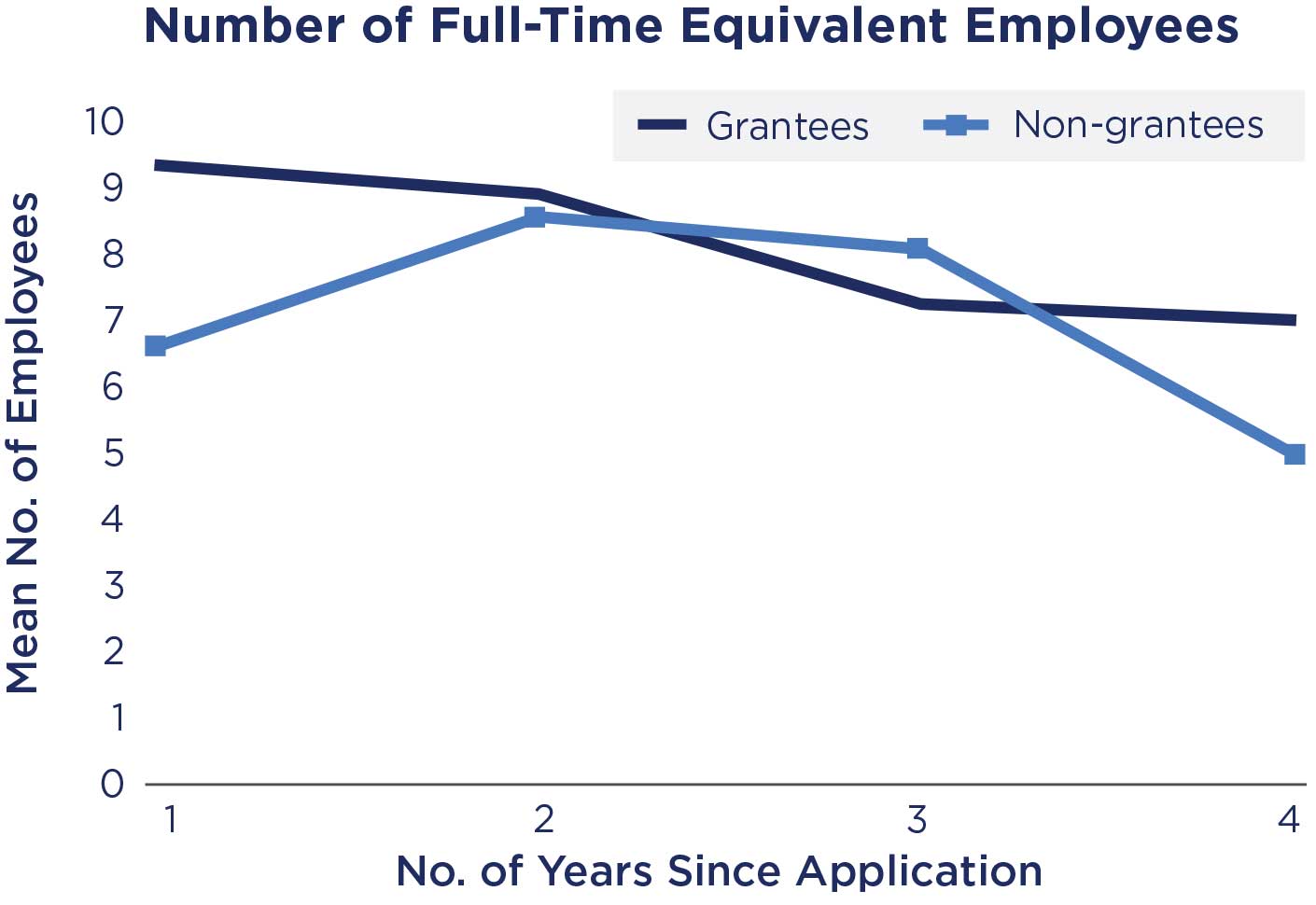

- Four years after applying for the grant, both grantees and non-grantees reported increasing their number of employees.

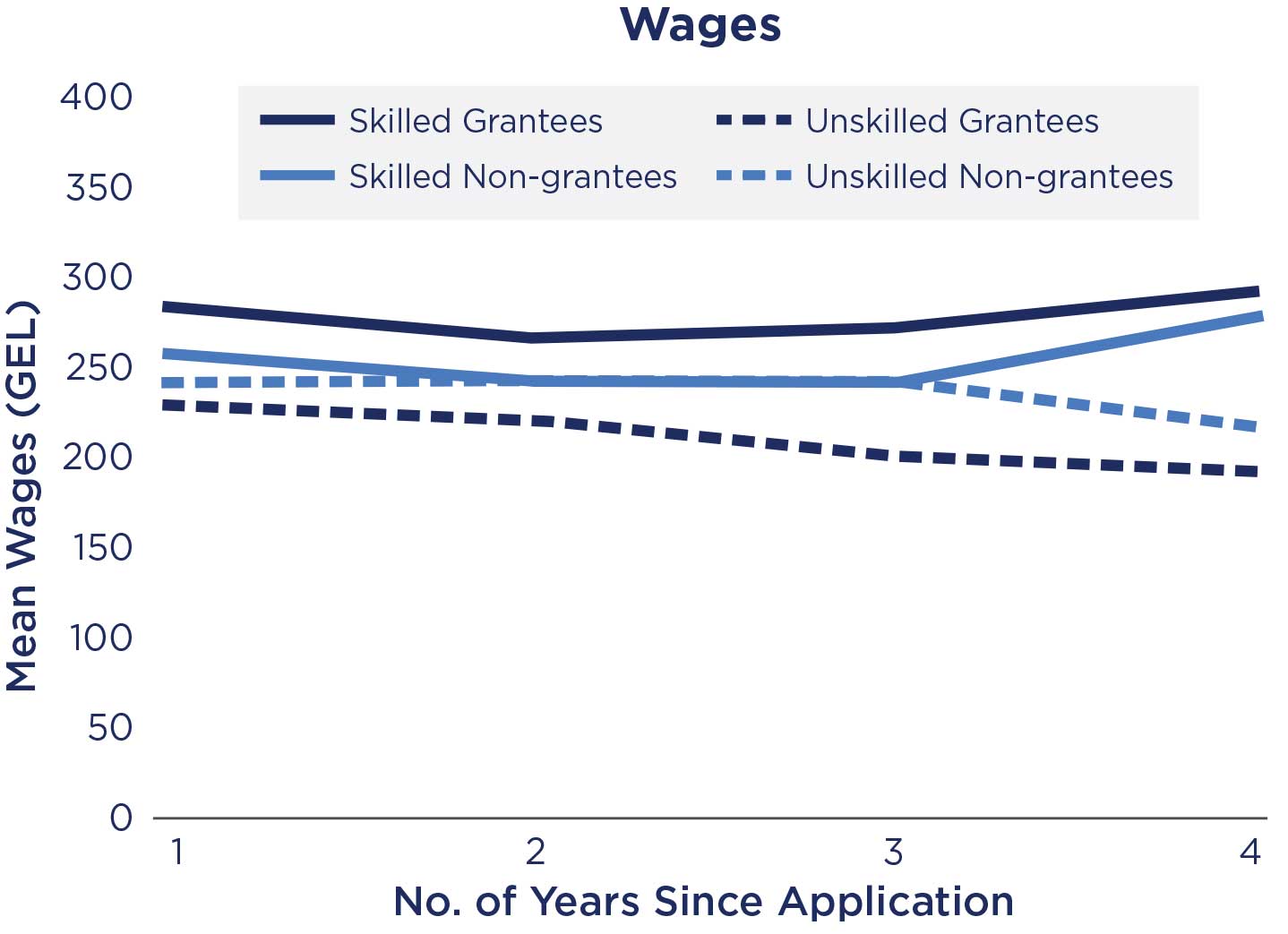

- Both grantees and non-grantees tended to report paying higher wages. After adjusting for inflation, however, wage levels for both skilled and unskilled workers remained relatively constant over time for both grantee and non-grantee agribusinesses.

Evaluation Questions

This evaluation was originally designed as an impact evaluation, but was later reverted to a performance evaluation due to data limitations and implementation changes, as described in the evaluation methods section. This final performance evaluation was designed to answer the following questions:

- 1

What is the ADA’s impact on economic growth and poverty reduction; including household incomes and expenditures, employment, production value (goods and services), value added, investments, and other indicators in agriculture? - 2

What is the impact of the project on agricultural productivity and, if possible, income? - 3

What is the ADA’s impact on net agribusiness revenue, number and type of employees, employee wages, and use of equipment?

Detailed Findings

Investment and Access to Credit

Grantees and non-grantees identified a range of investments that they made in their businesses. Grantees indicated investing in new technologies and production practices, while non-grantees highlighted investing in land use and input purchases. The survey data suggests the ADA grants were predominately used to invest in machinery.

Both grantees and non-grantees discussed an increase in access to credit, which was substantiated by the survey data. The number of respondents with bank loans increased for both grantees and non-grantees, with grantees showing an increase of 10 percentage points over non-grantees for the four year period since applying for the grant.

Production and Profit

Both grantees and non-grantees tended to reflect the national trend in reporting increases in production levels and profits. For grantees, this was largely attributed to investing in machinery that increased efficiency, adopting new techniques acquired in training, and using new technologies. Non-grantees, on the other hand, cited increases in the scale of their operations and market prices of their products.

As with volume of production, grantees had higher levels of profits one year after applying for the grant, but the evaluator couldn’t determine whether this was due to the grant or due to the fact that grantees were more profitable irrespective of the grant. This finding should not be interpreted as evidence that the ADA did not impact profits. Rather, the data and methodology were not able to clearly identify any increase in profits for grantees as compared to non-grantees.

Employment and Wages

Both grantee and non-grantee groups reported increasing their number of employees, which was generally due to expanding the scale of business or in some cases diversifying into new activities. In the years after the grants were received, by contrast, the survey data showed a decline in employment for both grantees and non-grantees. Grant recipients initially had more employees than non-grantees, but non-grantees tended to increase employment in the early years following the grant period. By four years after the application period, grantees employed an average of 7.0 full-time equivalents compared to 4.9 for the non-grantees.

In terms of wages, both grantees and non-grantees reported paying higher wages. However, after adjusting for inflation, the survey data showed wages for skilled and unskilled workers remained relatively constant over time at nearly the same level for both grantees and non-grantees.

MCC Learning

Randomized lotteries are not just tools for impact evaluations. In grant-making programs where demand significantly outpaces supply, a randomized lottery can be an effective tool in addressing transparency and fairness issues in the selection process.

Align application procedures with the level of sophistication of potential applicants.

Design processes and procedures for grant administration to mitigate fraud and abuse.

Involvement of the evaluator in data collection from the beginning is key to a successful impact evaluation.

Evaluation Methods

Bee-keepers that received an ADA grant.

The ADA was initially planned to allow for a randomized design and regression discontinuity impact evaluation. However, due to fewer and more heterogeneous beneficiaries than planned, the more rigorous impact evaluation was not feasible. Additionally, there were problems with the initial two rounds of data collection, which were contracted separately from the final performance evaluation with limited involvement on the part of the evaluator. As a result, the quality of the data was compromised, rendering much of it unusable. Therefore, the evaluation was converted into a performance evaluation combining quantitative and qualitative data sources. As a result, the evaluation could not rigorously attribute any impacts from MCC’s investment.

Farm service centers before receiving assistance from the ADA.

Farm service centers after receiving assistance from the ADA.

The evaluation used a mixed-methods approach that combined qualitative data with descriptive quantitative analysis. Qualitative data collection included 11 focus group discussions and 25 in-depth interviews covering a total of 69 respondents. The qualitative findings were supplemented by considering trends in descriptive statistics from a quantitative survey of ADA beneficiaries and a comparison group that was conducted over three rounds in 2008, 2010, and 2012. The first grants were disbursed in March 2007 and the final grant was disbursed in December 2010, with the exposure period varying from 12 to 60 months.

2020-002-2384