Program Overview

MCC’s $301.8 million Benin Compact (2006-2011) funded the $15.5 million Access to Financial Services (A2F) Project. The project directly supported improvements in Benin’s microfinance environment, and it provided 65 grants aimed to improve the efficiency of micro-, small-, and medium-sized enterprises (MSMEs) by improving their access to financial services, increasing self-sufficiency of microfinance institutions (MFIs), decreasing MFIs’ at-risk portfolio, and increasing loans guaranteed with land titles. The project’s theory was that increased access to credit and improved profitability of MFIs would increase investment and employment, leading to reduced poverty through economic growth.

Evaluator Description

MCC commissioned NORC to conduct an independent final performance evaluation of the Access to Financial Services Project. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/177.

Key Findings

Project Implementation

- Seeking a suitable agent to manage this project was challenging. Two unsuccessful attempts to procure an affordable implementer left the Benin MCA (MCC’s implementing entity) with only two years to manage the project directly.

- Ensuing time pressures led to challenges in grant disbursements and grantees’ oversight, leading to a relatively standardized configuration of grantee packages, heavily focused on equipment.

Performance of the Regulator

- The majority of MFIs expressed a positive and supportive judgement regarding the Regulator in strengthening the MFIs in Benin.

Project Implementation Challenges

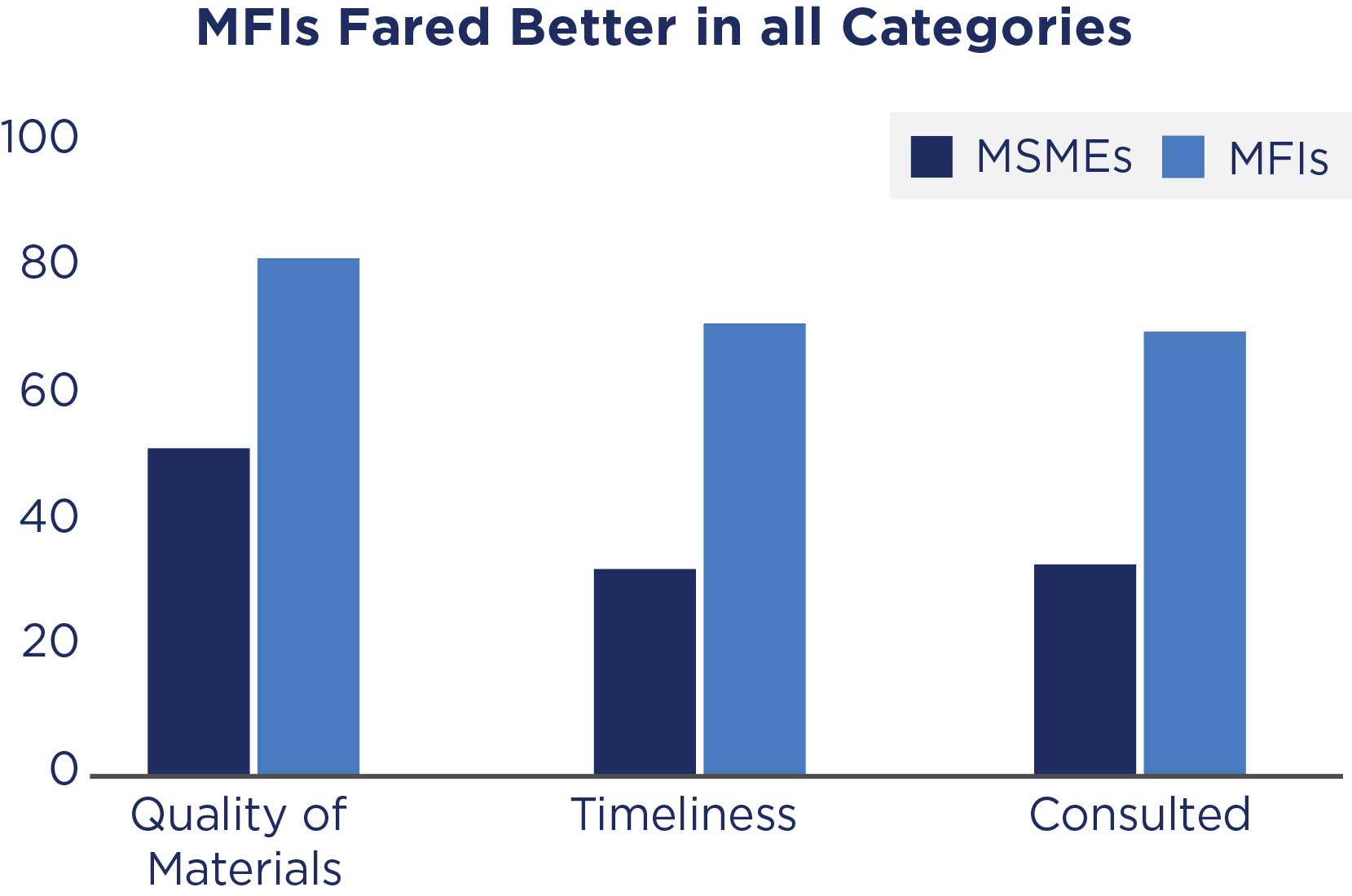

- Four out of five MFIs found the equipment procured to be of high quality, compared to only half of MSME grantees; moreover, more than half of the MSME grantees did not participate in the procurement of the equipment/items they received, and one third had no contact with their suppliers prior to delivery.

Access to Finance for MSMEs

- Numerous MFIs acknowledged an increase in their funding; yet this did not translate into more credit for MSME grantees, due to high risks of lending in the country.

Capacity of the Grantees

- No significant effort was made to improve grantees’ soft skills needed for strengthening enterprise capacity.

Evaluation Questions

This final performance evaluation was designed to answer a series of evaluation questions, a subset of which are:

- 1

Did the local context where the Compact was implemented favor or hinder the Compact activities? What were the main local constraints that influenced project implementation? - 2

To what extent has the regulator contributed to improved overall MFI loan portfolio quality and financial performance? - 3

To what extent has regulator supervision contributed to capacity building in MFIs in the sense of capability for supervision preparedness? - 4

Do transactions take less time? - 5

Did deposits and lending activity increase? - 6

Did operating costs decrease and profits increase?

Detailed Findings

Project Implementation

As per MCC grant facility model, the Benin MCA originally sought to hire an external agent to implement this project but was unable to find an affordable and acceptable third-party implementer, despite multiple, time-consuming efforts. Consequently, the MCA chose to implement this Challenge Facility’s procurements directly. The delays of the failed implementer search meant that the project needed to be implemented in the remaining two years of the five-year compact.

The project-provided grants were distributed across three broad functional groupings of MSMEs: 42 organizations, associations, and cooperatives that improved capitalization and creditworthiness of members through some training but mostly equipment; 14 MFIs needing technical and material support to improve their internal financial management; and nine financial institutions improving their efficiency through innovative technologies that reduced costs directly, or achieved economies of scale by connecting and integrating financial and accounting services provided to dispersed rural branches.

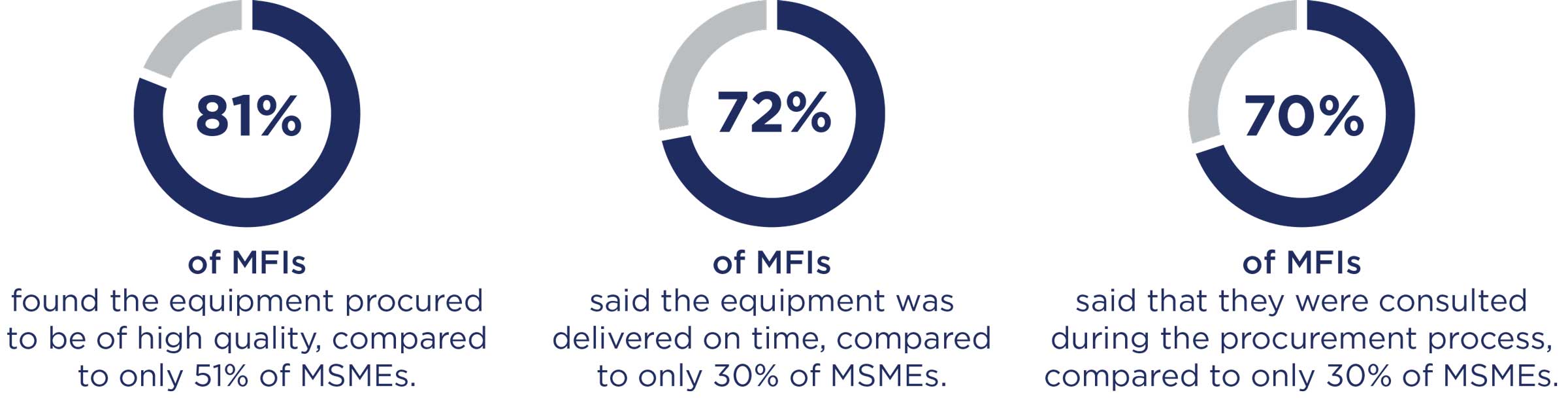

In terms of procurements, MFIs appeared to have a more positive experience with procurement: 81 percent of MFIs found the equipment procured to be of high quality, compared to only 51 percent of MSME grantees. Compared to 30 percent of MSMEs, 72 percent of MFIs said the equipment was delivered on time. It is possible that the difference in the MFI and MSME experience may result from the fact that 70% of the MFIs confirmed that they were consulted during the procurement process while only 30% of the MSMEs gave a similar response.

Performance of the Regulator

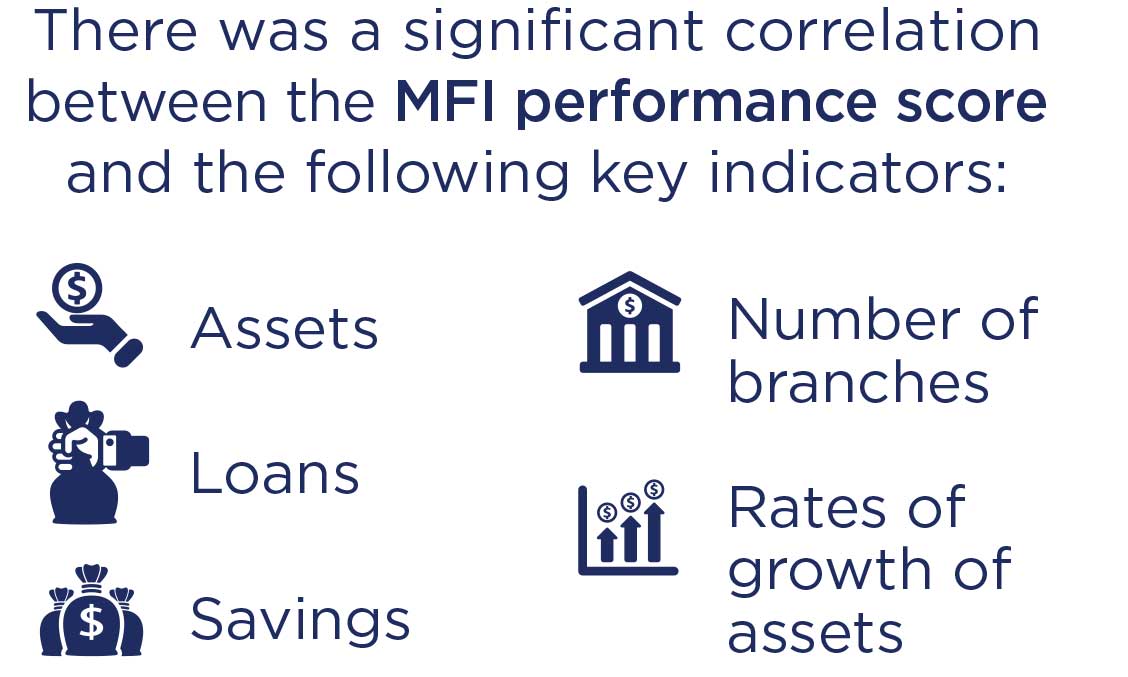

Strengthening the Regulator was part of the Financial Enabling Environment Activity. In this regard, most MFIs expressed a positive and supportive view of the Regulator’s role in strengthening the MFIs. The evaluation found a significant correlation (98 percent significance) between the MFI performance score and other key indicators such as assets, loans, savings, number of branches, and rates of growth of assets.

Access to Finance for MSMEs

Although about 41 percent of MFIs improved their access to commercial finance, MFI access to capital did not necessarily translate to MSME access to capital. The evaluator concluded that improving financial services is not synonymous with improving access to capital by MSMEs, which requires additional conditions to be satisfied such as reducing the risks associated with lending to MSMEs and interest rates that are affordable by such enterprises.

Capacity of the Grantees

Most enterprises that were supported lacked, and still lack, basic management tools such as a double entry accounting system, operational manuals and procedures, market research expertise, quality control, and customer data base management. Moreover, no significant effort was made to address these soft skills for strengthening enterprise capacity. The evaluation also found an association between failed or failing enterprises and those which could provide financial data.

MCC Learning

It is important to build upon existing potential in the finance sector in the partner country by collecting baseline data to understand the situation on the ground before project design and implementation.

Improving financial services required additional conditions such as reducing the risks associated with lending to MSMEs and offering interest rates that are affordable by such enterprises.

Access to Finance projects could be more successful if they are preceded by an assessment of the components of the entire value-chain of the sector in the design phase, allowing for more investments in necessary soft-skills.

In addition to hardware support and financial supervision, a policy dimension to strengthen MFI governance and institutional capacity must be considered.

Evaluation Methods

IRA, a Pineapple Juice Maker and one of the beneficiary MSMEs, received 79,905,970 FCFA in grant.

The evaluation was initially designed as an impact evaluation. However, due to challenges related to internal validity of the evaluation methodology (including loss of representative control versus treatment groups) as well as contract management issues, MCC and NORC agreed to switch to a pre-post performance evaluation.

Surveys and data sources: Official documents from line ministries and implementing entities were the main data sources. Additional focus group discussions with former program participants and key informant interviews contributed to data used for the evaluation. Additionally, the evaluation team interviewed 42 MSMEs and 32 MFIs on their transactions and financial records. However, of the 74 institutions interviewed, only 44 (including 21 MSMEs and 23 MFIs) were able to provide complete record data of their portfolio between 2009 and 2015.

Exposure period: Due to the loss of baseline data and changes in the evaluation methodology, the exposure period became difficult to determine. It is estimated to be around 72 months.

2020-002-2385