Program Overview

MCC’s $301.8 million Benin Compact (2006-2011) funded the $188.7 million Access to Markets Project. The project aimed to reduce ship waiting time, streamline customs clearance, improve user satisfaction, and reduce the average duration of the stay of trucks within the Port of Cotonou. The project was based on the theory that the improved physical infrastructure would lead to increased collateral investments and private sector activity, ultimately stimulating economic growth and reducing poverty.Evaluator Description

MCC commissioned NORC to conduct an independent final performance evaluation of the Access to Markets Project. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/182.

Key Findings

Operational Efficiency

- Operational efficiency (as measured by ship and crane productivity) substantially increased at the South Terminal compared to pre-investment levels. For instance, the port increased its capacity threefold and allowed for adequate handling of increased demand.

- The overall Benin Terminal’s (also known as South Terminal) crane productivity saw a significant improvement vis-à-vis 2006 estimates.

Costs for Port Users

- Overall, import and export costs were reduced for port users.

- Most cost savings went to main port users and shipping lines, thus failing to affect the final market prices.

Port Competitiveness

- More diverse types of ships (including larger vessels) are now able to use the Port of Cotonou compared to the pre-investment period where ship sizes were limited.

- The Port of Cotonou moved from being the worst in the region to competing with neighboring ports in terms of fleet and connectivity.

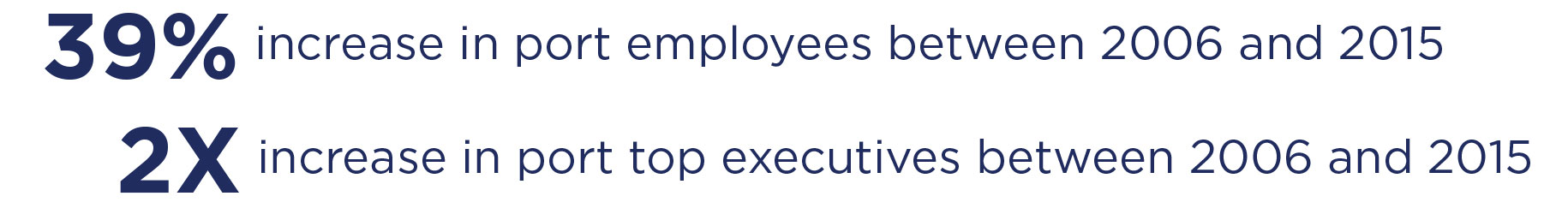

Port Employment

- Employment increased between 2006 (pre-investments) and 2015 (after closeout); however, increases in employment did not translate to increases in productivity.

Internal Markets

- Internal market integration did not significantly advance as a result of the port expansion; that is, the evaluation found no significant trade enhancement between local producers and consumers due to the investment.

- However, there were signs of improved regional market integration through transport services into neighboring and hinterland nations.</li

Evaluation Questions

This final performance evaluation was designed to answer the following questions about whether the project saw:- 1 An improvement in the port’s operational efficiency?

- 2 Any relative change in the cost of doing business to port users?

- 3 Competitiveness changed vis-à-vis other ports since 2006?

- 4 Any change in trade volumes?

- 5 Any net change in permanent and non-permanent employment at the port?

- 6 Success in achieving integration and internal market development?

Detailed Findings

Operational Efficiency

Introducing gantry cranes substantially increased operational efficiency at the South Terminal. Productivity reached 45 moves per hour in the first half of 2016 compared to 7-20 moves per hour prior to the investment, an improvement of between 125 percent and 542 percent in productivity. In comparison, during that period Cotonou outperformed Lomé and Tema (32 and 35 moves per hour, respectively). Note that MCC infrastructure investment focused on the South Terminal and the South Wharf.Costs for Port Users

Shippers experienced reduced import and export costs through Cotonou; the reduced costs were comparable to other ports in the region with similar infrastructure improvements (Lomé and Tema).The improved facilities also benefited the shipping lines, the other main port users. They experienced reduced time at the port and deployment of larger vessels resulted in cost savings. Due to limited competition and the industry’s pricing practices, these cost savings are not passed through the system to other port users and shippers.

Bypass road during construction.

Port Competitiveness

Larger ships are now able to call on Cotonou, as are gearless vessels. As a result, Cotonou’s connectivity increased 61 percent since 2006. Traffic increased, in addition to trans-shipment volumes. Trans-shipment volumes, for instance, increased from less than 4,000 TEUs in 2013 to 100,000 TEUs in 2015, and the overall port capacity increased by threefold thanks to the construction of the Benin Terminal. Costs for importing and exporting goods decreased and are competitive with other main regional ports. Moreover, prior to the investment, Cotonou ranked worst out of the competing ports in terms of fleet profile and connectivity. At the end of the investment, Contonou was comparable to its competitors.

Port Employment

Port employment increased from 2006 to 2015. Notably, port permanent employees increased by 39 percent and top executives doubled. Labor costs for the port increased by 55 percent, corresponding with a 57 percent profit increase. These increases, though, did not correspond with an increase in productivity. Employment productivity decreased 30 percent, as measured in employment productivity per metric ton from 2008 to 2014, due to the fact that increases in volumes did not keep up with increases in employment.

Internal Markets

The evaluators were not able to identify any significant advancement that the project affected with respect to formal trade or, indeed, with respect to trade enhancement of any kind between producers and consumers. With that said, one area of potential project-related gain involves the regional transport market. However, the cause and effect relationship between these regional markets’ integrating initiatives and the project are indirect.

The new truck terminal at the Port of Cotonou.

MCC Learning

- MCC’s logic and assumptions suggested that an investment in the incremental port capacity would lead directly to positive economic returns, measured in terms of job creation in Benin’s manufacturing, agribusiness processing, and non-port service sectors. Investment in port infrastructure is a necessary but not sufficient condition for economic growth. MCC acknowledges that a more rigorous constraints analysis upstream could have determined that neither port capacity nor efficiency were binding constraints to growth.

- Engineering design plans must be subject to several checks, including ones from shipping agents and major container lines. Engineering design plans should be finalized only after the concession is awarded. MCC acknowledges that the design underestimated the need for a focus on private sector development.

- If plans are essential to the program logic, MCC should ensure that they will be completed. MCC acknowledges that the plans for Port of Cotonou to transform itself from service port into landlord port never materialized.

Evaluation Methods

This ex-post performance evaluation primarily used administrative data from the Cotonou Port Authority and customs services.The administrative data included official documents on transactions within the port and financial statements across multiple years, which were the main data sources. Additional focus group discussions with former and then-current program participants and key informant interviews with former and then-current Port of Cotonou officials contributed to data used for the evaluation.

Terminal managed by Bolloré under Concession Agreement.

South Wharf during construction.

2020-002-2484