Program Overview

MCC’s $385 million Philippines Compact (2011–2016) supported three projects, one of which was the $30 million Revenue Administration and Reform Project (RARP). The project aimed to increase government tax revenues by (i) computerizing the processes at the Philippines’ Bureau of Internal Revenue, (ii) automating the audits of large taxpayer businesses, (iii) educating the public on the Bureau’s services and programs, (iv) strengthening the agency’s internal surveillance and discipline of Department of Finance staff and (v) providing the International Monetary Fund (IMF) technical assistance.

Evaluator Description

MCC commissioned NORC to conduct an independent final process and performance evaluation of the Revenue Administration and Reform Project. The two full reports of results and learning are here: Philippines - Revenue Administration Reform.

Key Findings

Project Implementation

- Portions of all the project components were implemented.

- New information systems improved efficiency, but their sustainability is at risk because of limits on the number of users and variation in the skills of staff.

- International Monetary Fund (IMF) advice was redirected half-way through the project because of the limited Bureau of Internal Revenue (BIR) implementation capacity.

Tax Revenue Levels

- Tax revenue from businesses increased but failed to meet the compact target.

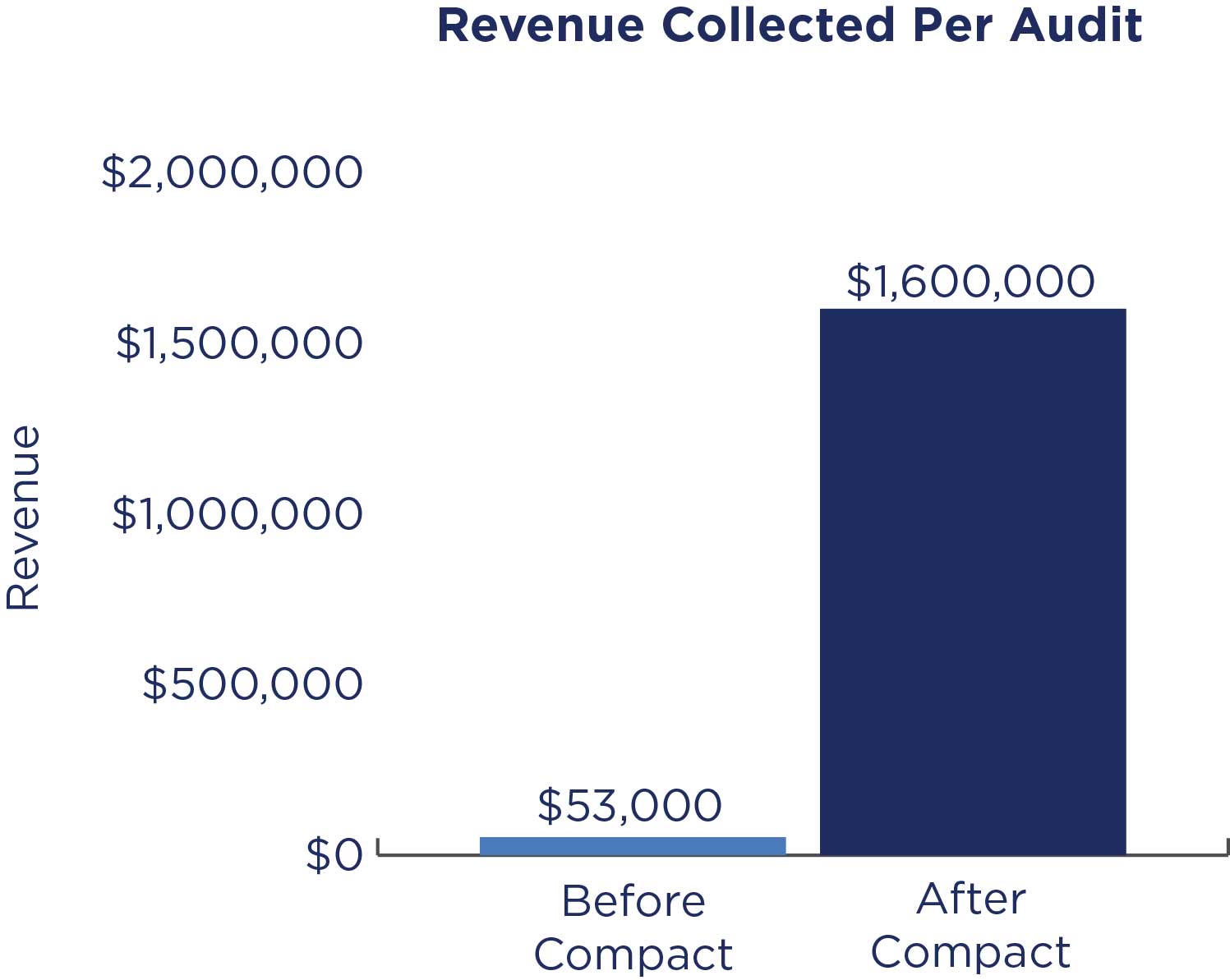

- The average revenue collected per audit increased from 2.5 million to 74.5 million Philippine Pesos.

Taxpayers’ Perception of Corruption

- The perception of corruption decreased significantly for the Bureau of Internal Revenue and for the Department of Finance (DOF), and remained essentially the same for the Bureau of Customs (BOC).

Evaluation Questions

Public awareness campaign of the RARP on billboard along a major highway in Manila; providing information on how to register, file and pay correct taxes.

This final evaluation included a process evaluation to examine the project implementation and a performance evaluation to study changes in taxpayer and staff awareness of tax responsibilities and perceptions of corruption.

The process evaluation sought to answer the following questions:

- 1

How were the programs implemented and did the new systems improve on the old ones? - 2

Do staff know and use the new systems? What incentives do the staff have to use the new systems? - 3

To what extent has the project accomplished its outputs and outcomes? - 4

What are the results of the IMF Technical Assistance?

The performance evaluation examined the following changes during the project:

- 1

Taxpayers’ awareness of and satisfaction with tax registration, filing, payment and audit, and taxpayer compliance. - 2

Taxpayers’ and Department of Finance (DOF), Bureau of Internal Revenue (BIR), and Bureau of Customs (BOC) personnel’s perception of corruption within the three agencies (DOF, BIR, and BOC), and the incidence of corrupt activities within the DOF, including BIR and BOC. - 3

Awareness of DOF, BIR, and BOC personnel about the Revenue Integrity Protection Service (RIPS) and about the actions taken by the RIPS against corrupt activities.

Detailed Findings

Project Implementation

Five of the nine modules of the electronic Tax Information System (eTIS) were implemented within 13 pilot offices. BIR staff had limited exposure to the eTIS modules in terms of time (months) and number of staff, but BIR was committed to this new system, as the current system was failing. Approximately 344,000 taxpayers were registered into the new eTIS. Although automated auditing tools have been used in the Large Taxpayer Service office since 2005, the project provided 10 BIR offices with laboratories to train staff and conduct audits, increasing the percentage of Large Taxpayer cases using automated auditing tools from 3 percent to 100 percent. An additional auditing tool, the new ‘transfer-pricing’ database, had not been acquired at the time of the evaluation.

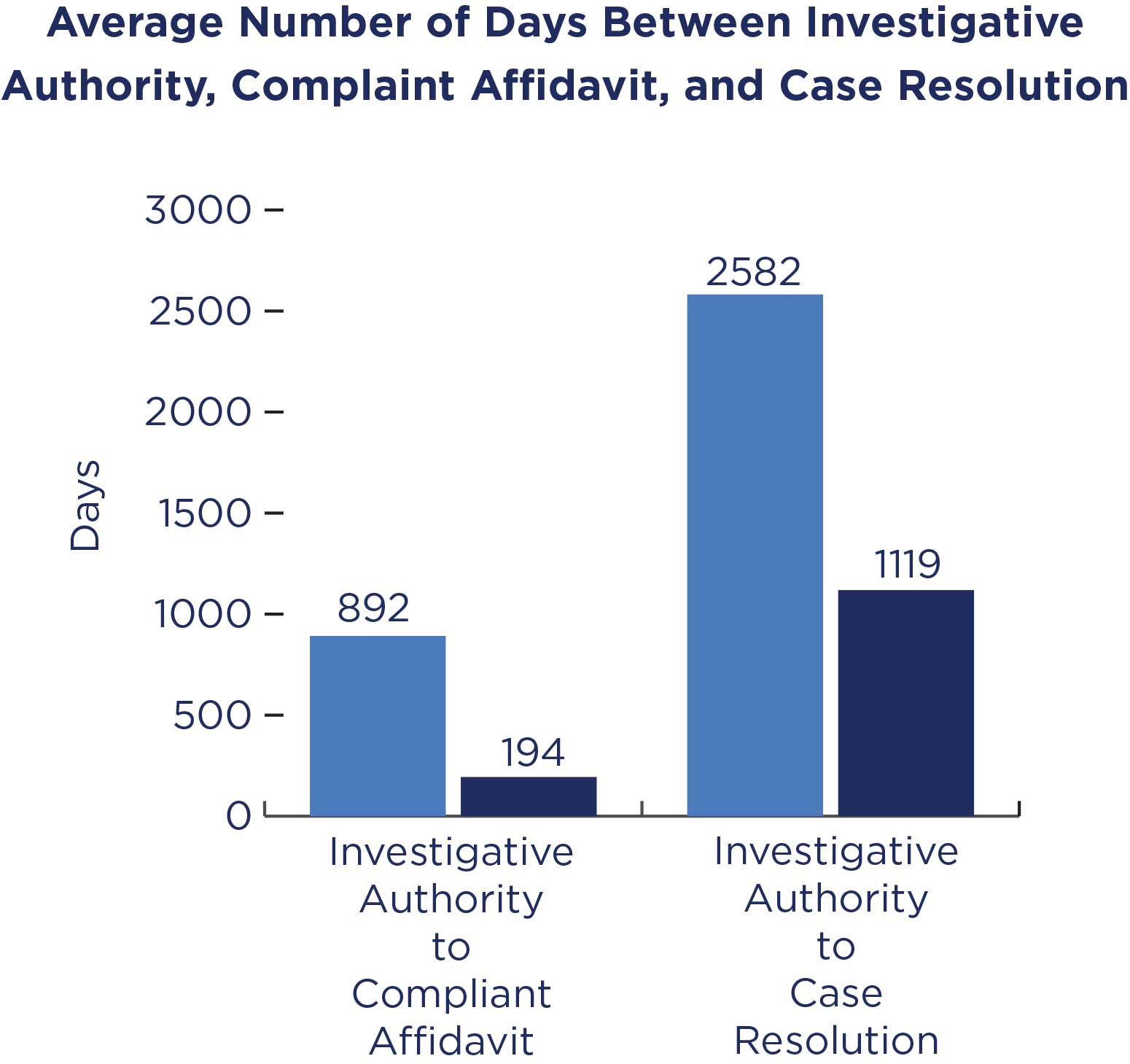

The case management system at the Revenue Integrity Protection Service (RIPS) faced numerous implementation delays. Even so, the capacity building and case management system seems to have improved the efficiency of RIPS investigations: the average number of days between Investigative Authority to Complaint Affidavit decreased from 892 to 194 and between Investigative Authority to Case Resolution decreased from 2582 to 1119.

The project’s Public Awareness Campaigns won awards and were deemed effective in improving taxpayers’ understanding of their tax obligations, per the evaluation. Even so, the impact on tax compliance was not measured by either the PR firm or the evaluation. In the future, each campaign should be analyzed in relation to the desired behavioral change (in this case, tax compliance) to better inform which campaigns should be continued and which should be closed.

This project was the first time that MCC engaged the IMF as a project resource for technical assistance. The IMF was allowed the flexibility to independently identify problems and recommend timely measures to address them. As a result, the IMF advisory activities were free to focus on several critical topics including Value-Added Tax (VAT) audit and arrears management.

Tax Revenue Levels

Tax revenue from new and existing businesses registered with the BIR rose from approximately $17.5 billion (822,624 million Philippine peso (PHP) using 12/31/2015 exchange rate) to approximately $31 billion (1,441,571 million PHP), but tax revenue was increasing before the project.

Revenue collected per audit increased from $53,000 (2.5 million PHP) to $1.6 million (74.6 million PHP) surpassing the compact target. The percentage of automated audits increased from 3 percent at baseline to 100 percent by compact end.

Taxpayers’ Perception of Corruption

The percentage of taxpayers believing there is a great deal of corruption in the DOF and BIR decreased significantly between 2014 and 2015: DOF from 48 percent to 38 percent and BIR from 52 percent to 46 percent. On the other hand, the percentage of taxpayers believing there is a great deal of corruption in the BOC barely changed: from 74 percent to 72 percent.

Perceptions of corruption in the DOF, BOC, and BIR differ greatly between taxpayers and agency personnel. A far higher percentage of taxpayers, compared to personnel, believed corruption in all three agencies to be extensive. Agency personnel’s perception did not change significantly from 2014 to 2015.

Approximately one-third of the taxpayers surveyed faced bribe solicitation during 2014 and 2015. Compared to other taxpayers, Large Taxpayer Services taxpayers were more frequently approached for bribes by the BIR personnel. A smaller percentage of Large Taxpayer Services taxpayers were solicited for bribes by BIR personnel in 2015 as compared to 2014. Despite this decrease, the reported incidence of paying bribes by the Large Taxpayer Services respondents did not change between the two rounds.

MCC Learning

On projects that involve installing and adopting major IT systems, MCC must ensure no more than a manageable level of customization to off-the-shelf software systems. The volume of modification and customization of software in the eTIS system ultimately reduced the scope and reach of the final product.

In terms of RIPS, even though case resolution went from 2582 to 1119 days, it still takes, on average, more than three years to resolve a case, because of other entities both in the judicial system and within the Department of Finance. MCC should address this risk by including other entities in the project, assuming buy-in can be obtained.

Evaluation Methods

(1) Process Evaluation of the Revenue Administration and Reform Project (RARP), including the eTIS, Automated Auditing Tools and Techniques, Revenue Integrity Protection Services, and IMF Technical Assistance.

This evaluation was a process evaluation conducted near the end of the project. The evaluators relied on key informant and focus group interviews and document review. Three focus group discussions were conducted with BIR staff: one for eTIS and IMF technical assistance, one for AATS, and one for RIPS. The evaluation team also conducted several key informant interviews with AATS and eTIS project managers, former and current deputy directors of RIPS, and RARP’s current director. Finally, MCA-Philippines, the implementing entity, shared several documents with NORC, including administrative data on corruption cases charged by RIPS from 2003 to 2015 (by gender and by office – DOF, BOC, and BIR); average response time (minimum, maximum, and mean) to conduct an investigation at RIPS; capacity building training provided to RIPS staff; and MCA-Philippines monitoring and evaluation indicators for the RARP. BIR and RIPS did not share any raw data for verification due to confidentiality issues. Data collection occurred in February of 2016 and the compact ended in May 2016.

Inauguration of the Computer-Assisted Audit Tools and Techniques (CAATS) training room with BIR management, MCA-P and MCC senior officials and former US Ambassador to the Philippines Harry K. Thomas, Jr.

(2) Baseline and Follow-up Analysis of Survey of Taxpayers and Officials for Assessing the Performance of RARP

This performance evaluation analyzed data from taxpayers and employees both before and after the project. Baseline surveys were conducted from July to December 2014, and follow-up surveys were conducted from September to December 2015. The surveys were administered to taxpayers (sample size: 720 baseline and 776 follow-up) and employees of BIR, BOC, and DOF (sample size: 893 baseline and 778 follow-up). The compact ended in May 2016. Exposure periods were less than one year.

2020-002-2481