Program Overview

MCC’s $271 million El Salvador Investment Compact (2015–2020) aimed to improve El Salvador’s competitiveness by increasing private investment through the $41 million Investment Climate Project, comprising the El Salvador Investment Challenge (ESIC), Regulatory Improvement Activity (RIA) and Public-Private Partnerships (PPP) Activity. MCC’s $28 million Guatemala Threshold Program (2016–2021) aimed to catalyze private investment in infrastructure through its $1.6 million PPP Activity. MCC conducted one joint evaluation due to the two programs’ similar nature and geographic proximity.Evaluator Description

MCC commissioned Mathematica to conduct independent interim performance evaluations of the El Salvador Investment Climate Project and the Guatemala PPP Activity. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/233.

Key Findings

PPP Support in El Salvador and Guatemala

- Support from El Salvador’s president helped secure legislative approval for the country’s first PPP. In Guatemala, a lack of political support from the executive branch and legislature for the first PPP led MCC to cancel its assistance.

- PPP investments in training and coaching contributed to building public officials’ capacity in El Salvador, but less so in Guatemala.

El Salvador Investment Challenge

- ESIC’s support for firms to navigate bureaucracy facilitated private sector investments. However, public investments experienced significant delays.

- The promise of ESIC’s public investments incentivized some companies to invest earlier than planned. However, there is no evidence that public investments generated matching private investments within the compact period.

Regulatory Improvement Activity in El Salvador

- Congress established a permanent institution, Organismo de Mejora Regulatoria (OMR), which is devoted to regulatory improvement, but it had few public and private allies by compact closeout.

- Changes in OMR’s leadership and focus likely contributed to only marginal reductions in the regulatory burden by compact closeout.

Evaluation Questions

The second interim evaluation report documented activity implementation and described early findings. Key evaluations questions included:- 1 How have activities and sub-activities been implemented by compact/threshold closeout?

- 2 Were the outputs and outcomes envisioned for the activities and sub-activities fulfilled as intended during the compact period?

Detailed Findings

PPP Support in El Salvador and Guatemala

In El Salvador, PPP authorities and the Ministry of Finance built in-house capacity to structure PPPs. MCC’s support for technical studies also helped advance PPPs in the transportation sector. This assistance, combined with strong political support, led to the first approval of an MCC-supported PPP in 2021. In Guatemala, public officials received less hands-on training and support due to curtailed coaching contracts and discontinued MCC support. Due to Congress’s initial struggle to ratify the first PPP and the lack of support from the executive branch, MCC canceled this activity in 2019—about two years before the end of the threshold program. In both countries, the presence (in El Salvador) and absence (in Guatemala) of political support was the key driver of PPP legislative approval.In both countries, local stakeholders appeared to have the basic organizational capacity required to develop and assess PPPs. In response to the first PPP being stalled in the Guatemalan Congress, the Government of Guatemala is leading efforts to limit Congress’s role in the approval process only to projects that provide public services or would incur financial liabilities for the State.

El Salvador Investment Challenge

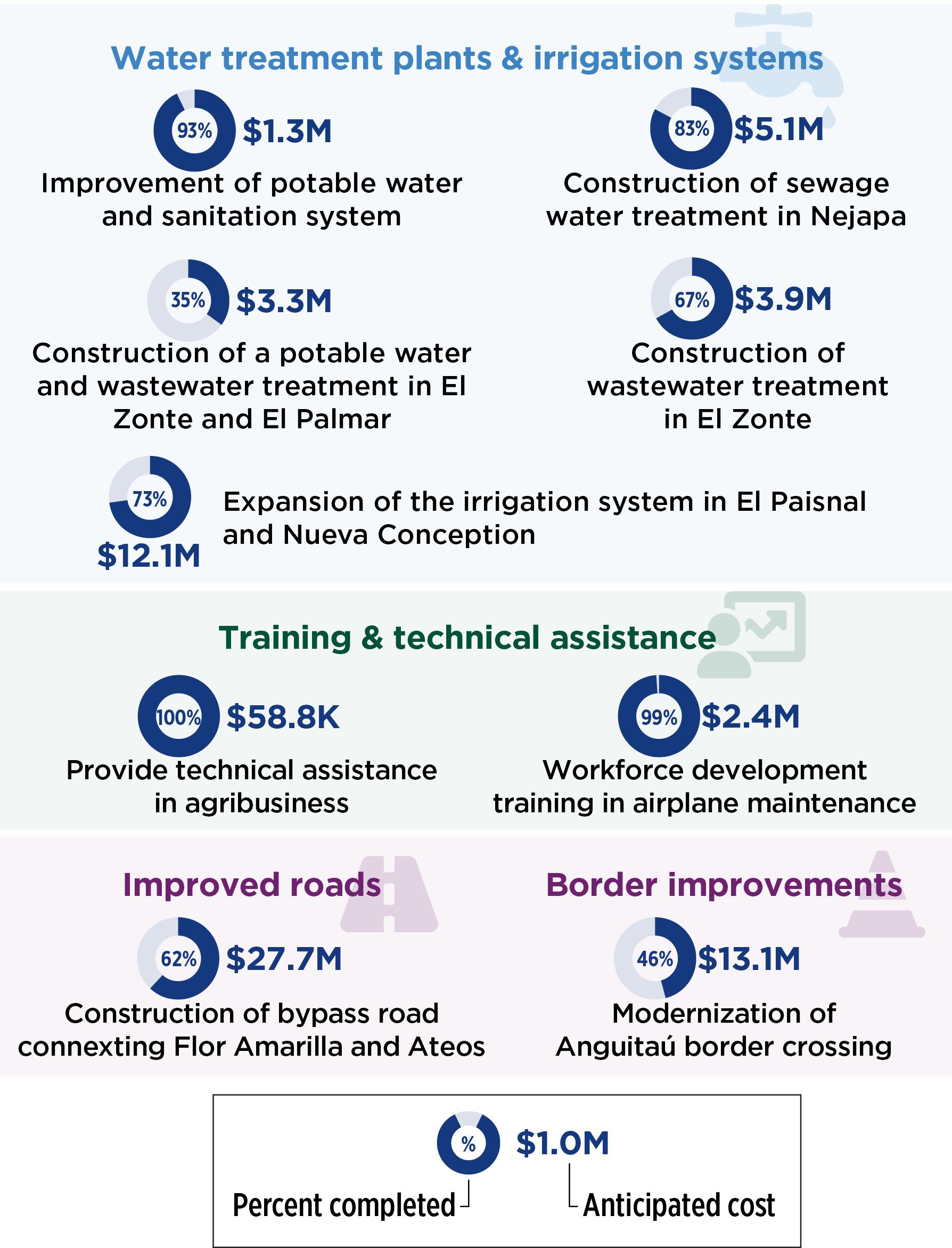

Status of ESIC public investments as of May 2021

Regulatory Improvement Activity in El Salvador

During the compact, OMR became a permanent institution devoted to simplifying and improving regulation in El Salvador. During the first half of the compact, OMR built a staff of economists, lawyers and policy experts to develop a national regulatory improvement strategy. In 2019, OMR transitioned from FOMILENIO II to Government of El Salvador funding, receiving its budget directly from government coffers. OMR convened public and private sector groups to harmonize terminology and identify priorities for regulatory reform. This collaboration diminished as RIA’s focus evolved, with private sector membership groups and firms reporting little awareness of OMR’s work by compact closeout. This appears to be a missed opportunity for further collaboration between the public and private sectors.During the compact period, OMR and executive branch ministries made headway on a National Procedures Registry—meant to be an official and transparent registry of all procedures the executive branch requires. However, OMR and partner institutions made little progress on other regulatory tools introduced in the new regulatory improvement law, such as regulatory improvement plans, regulatory agendas and impact assessments.

| Tool | Description | Progress at compact close-out |

| National Procedures Registry | All procedures with a legal basis are included in a public registry and updated. | As of April 2021, 2,047 procedures were included in the national registry. |

| Regulatory improvement plans | Ministries must develop annual plans for administrative simplification, or reduce the burden through streamlined processes. | By May 2021, 9 out of 16 ministries in the executive branch had regulatory improvement plans published on OMR’s site. |

| Regulatory agendas | Ministries must publish an annual list of laws and regulations they will produce or modify. | By May 2021, 11 out of 16 ministries had regulatory agendas published on OMR’s site. |

| Impact assessments | Ministries must conduct a cost-benefit analysis of new laws and regulations that affect businesses. | OMR provided only general guidance as of late 2020. The guidelines to complete the regulatory impact assessments were released in December 2020, but no training had been offered as of mid-2021. |

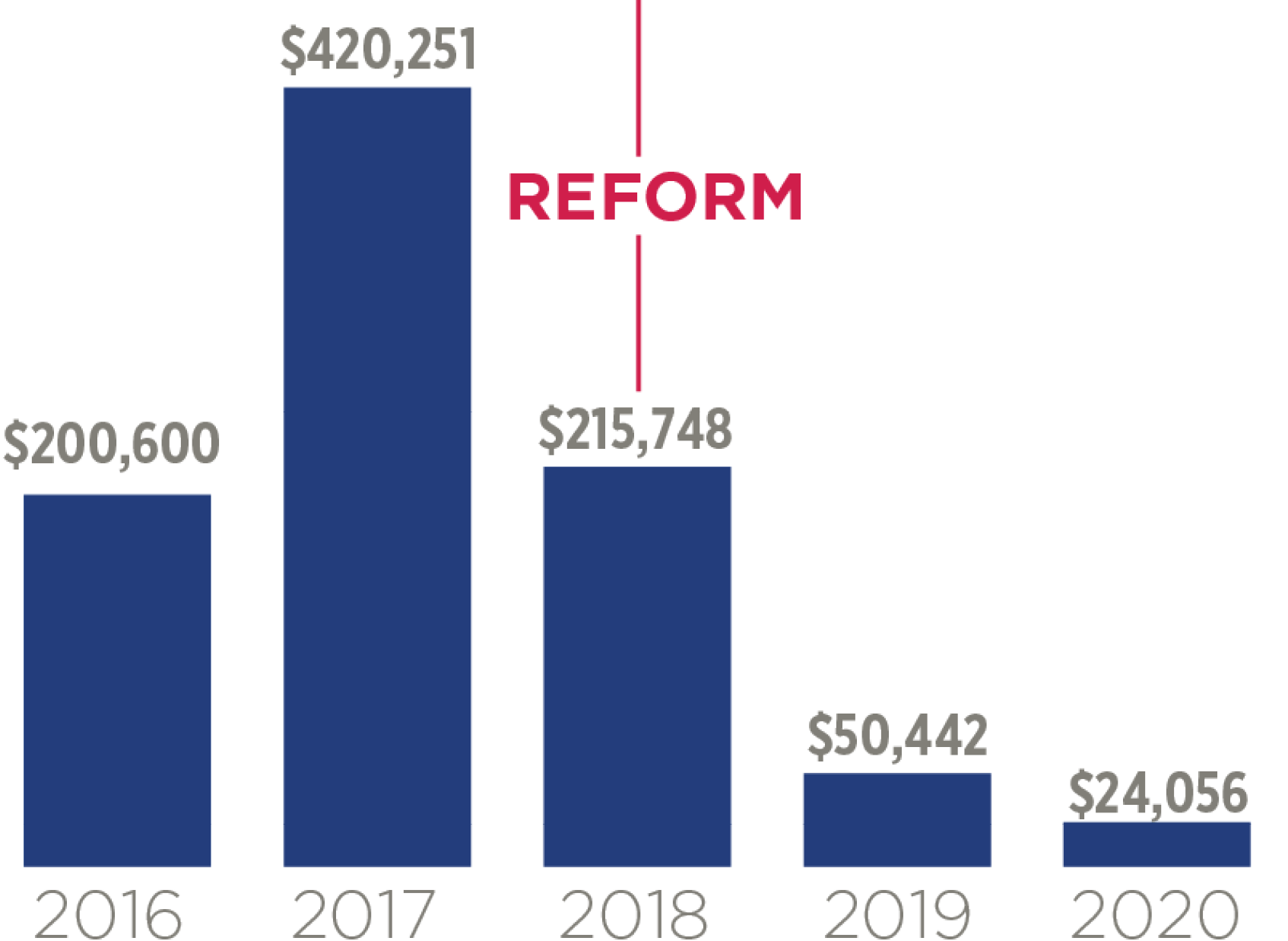

Weight discrepancy fines (in U.S. dollars)

MCC Learning

- Coaching for PPPs was particularly important in El Salvador and Guatemala and capacity building for government officials in structuring and implementing PPPs was just as important as successfully signing PPP agreements. MCC should emphasize coaching as part of any PPP investments in the future.

- Political support and incentives are critical for reform. The success or failure of the PPP initiatives in Guatemala and El Salvador came down to political support for the investments. MCC should incorporate incentives to support PPPs and reform to react to differing interests and inherently salient political landscapes.

- The ESIC mechanism was well received, but it took longer than expected to identify and complete the public works projects. When implementing similar projects, MCC should begin due diligence of the public works before the Compact starts and identify one or two types of works to streamline the identification process.

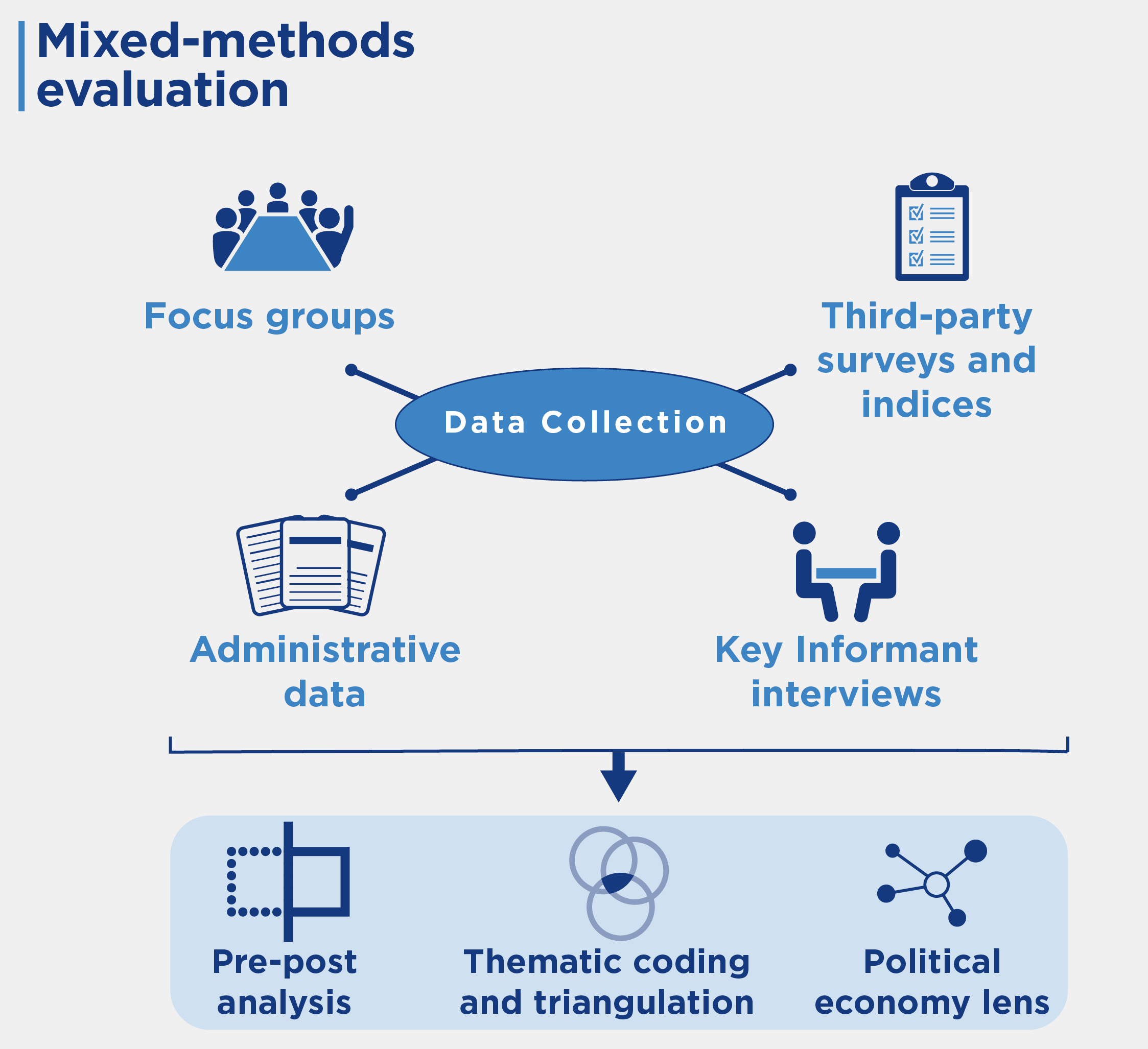

Evaluation Methods

For the second interim report, Mathematica used data from interviews conducted from mid-2020 to mid-2021 (documenting the second half of compact implementation from early 2019 through mid-2021), with approximately 77 individuals representing program implementers, relevant public authorities and firms affected by MCC-funded activities. The evaluator also carried out a brief survey of firms participating in ESIC. Mathematica used thematic coding and triangulation techniques to document and assess program implementation, identifying common and divergent themes across stakeholder types. Mathematica also used a political economy lens to assess implementation and early results.

For the final evaluation, Mathematica will collect primary data from businesses and use administrative data from five–six years after intervention onset.

Next Steps

Mathematica plans to submit a final report of findings for El Salvador and Guatemala in 2023. The final evaluation report will mainly focus on long-term results, ex-post costs and benefits, and sustainability.2021-002-2611