Program Overview

MCC’s $358 million Lesotho Compact funded a $17.9 million Land Administration Reform Activity within the Private Sector Development Project. The activity supported land policy and regulatory reform, streamlined land administration procedures, created the Land Administration Authority, conducted public outreach, and supported systematic land regularization. The activity was based on the theory that strengthened tenure and efficient land administration would reduce land conflict, drive formal land transactions, and increase investment and use of land as collateral, which would contribute to private sector development, especially for women.Evaluator Description

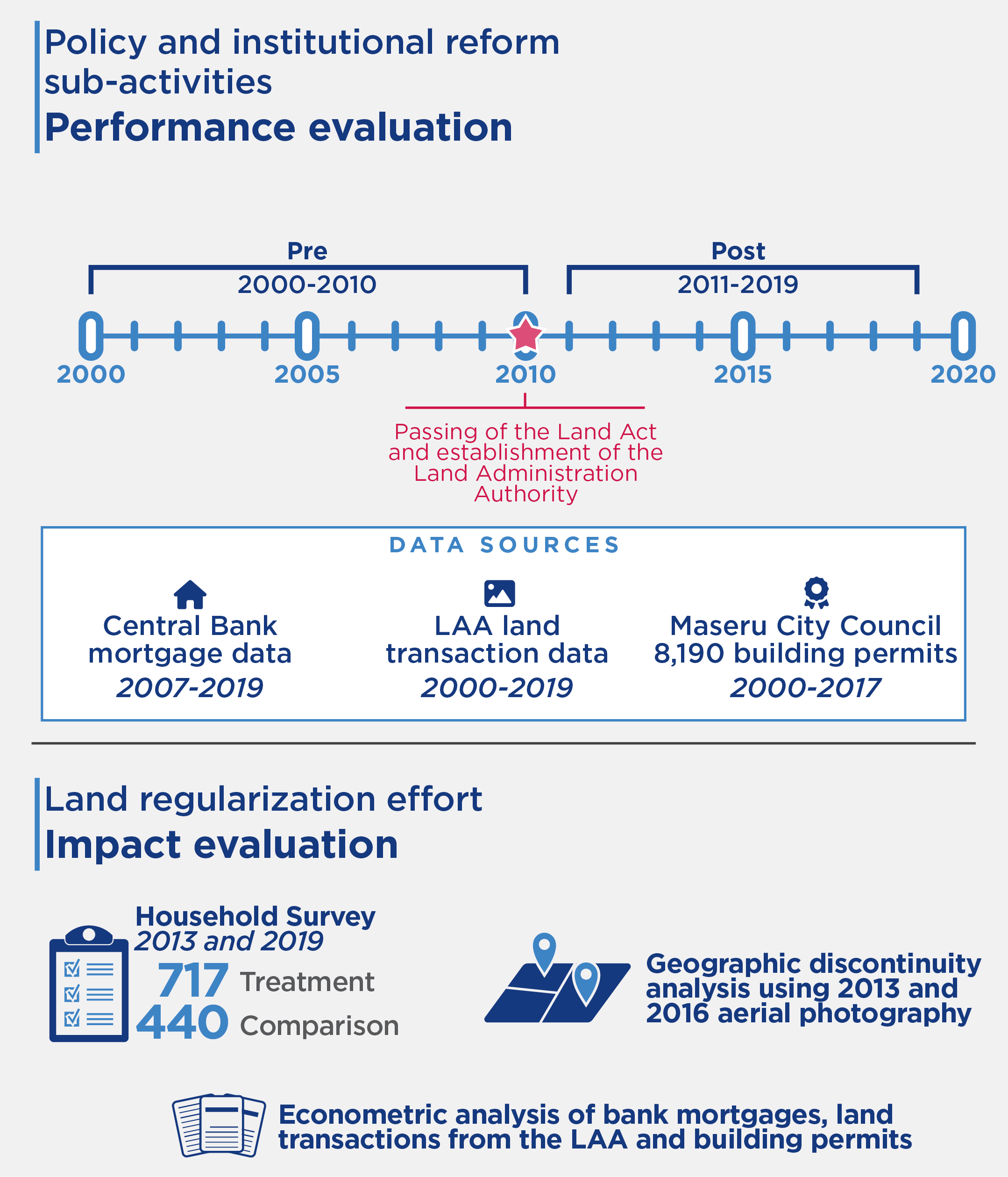

MCC commissioned the World Bank’s Development Economics team to conduct an independent final performance and impact evaluation of the Lesotho Land Administration Reform Activity. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/260.

Key Findings

Tenure Security and Conflict

- Women’s tenure improved with a 55 percentage point increase in women’s sole or joint ownership of newly registered parcels.

- Systematic land regularization decreased land conflict concerns by 5 percentage points for female-headed households but had no effect on the fear of losing land.

Land Transaction Savings and Land Markets

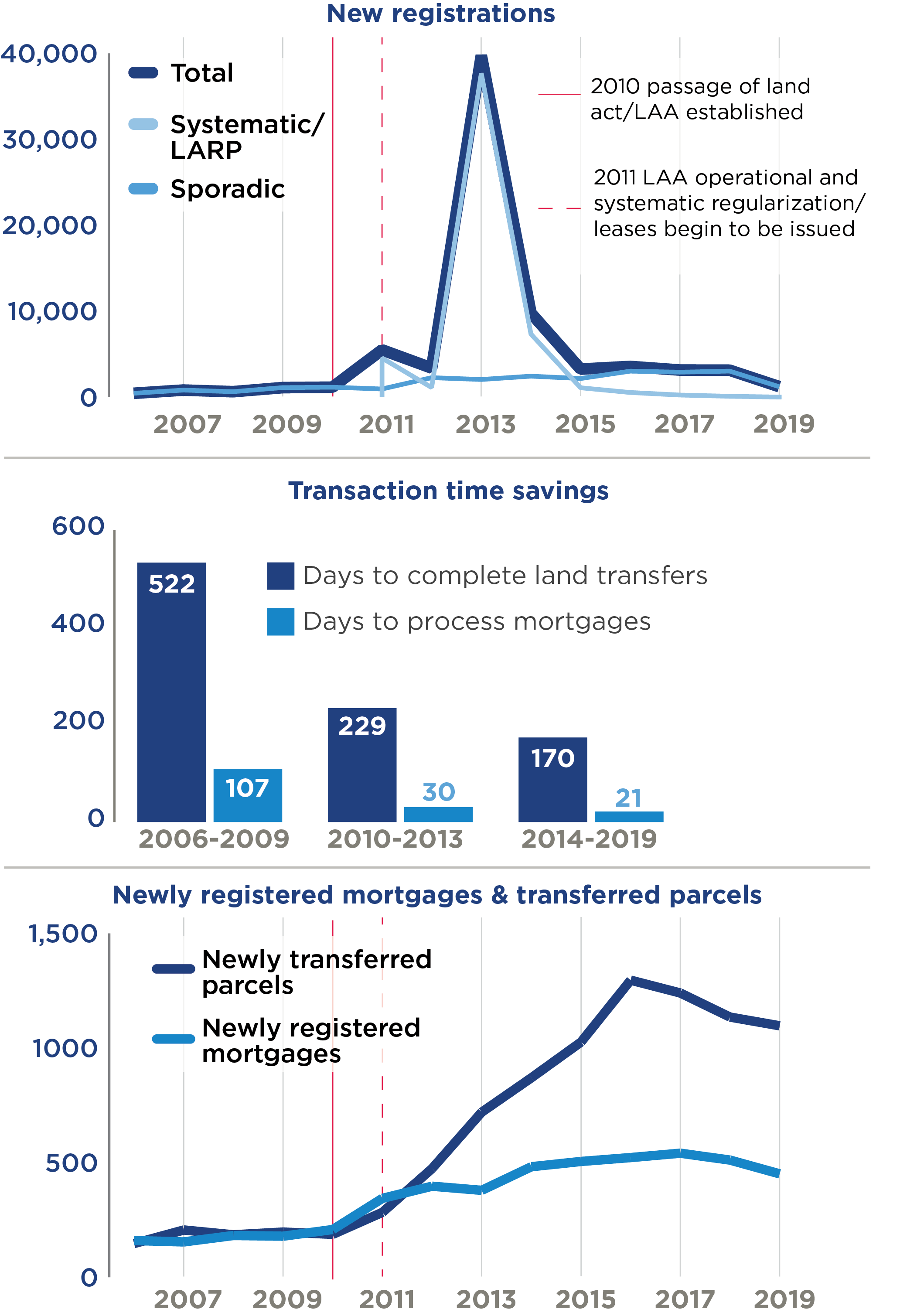

- The adoption of the 2010 Land Act and establishment of the Land Administration Authority were associated with significant reductions in transaction time. The average time to register a land transfer and mortgage fell by more than two-thirds (67 percent and 80 percent, respectively).

- The activity catalyzed land transfers from 165 a year in 2010 to 1,075 a year in 2019.

Investment and Access to Credit

- Policy and institutional reforms activated credit markets by more than doubling mortgages and increasing the share of mortgages issued jointly or in the name of women.

- Systematic land regularization in informal settlements did not result in land investment.

Evaluation Questions

This final mixed methods evaluation was designed to answer the following questions:- 1 Did the activity decrease the time to conduct a land transaction and incentivize use of the formal land system? How did the activity affect confidence in the land governance system, demand for formal land transactions and changes in land markets?

- 2 Was the activity able to increase tenure security and decrease land-related conflicts?

- 3 Did the activity contribute to property investments, access to credit or related changes in land values?

- 4 How did the above outcomes differ between men and women and those already in formal vs. informal areas?

Detailed Findings

Tenure Security and Conflict

Landholders obtaining leases

Although documented land rights increased, the evaluation did not find changes in perceptions of tenure security from the land regularization work as measured by the fear of losing land. However, amid minimal fear of land conflict (less than 5 percent at baseline), female-headed households decreased their concerns of land conflict by 5 percentage points.

Land Transaction Savings and Land Markets

The activity catalyzed land transfers from 165 a year in 2010 to 1,075 a year in 2019. From 2011—2013 transfers grew an average of 38% each year which more than quadrupled land transfers from 165 in 2010 to 698 in 2013. Transfers continued to climb an average of 18 percent a year from 2014—2016 with transfers reaching 1,274. Transfers decreased to 1,075 by 2019. Sporadically registered parcels were more likely to transfer land.

Investment and Access to Credit

In line with the project logic, the activity’s policy and institutional reforms, particularly removing the minister’s consent on mortgages, significantly improved access to credit. Mortgages doubled from an average of 168 per year in 2008—2010 to 351 per year in 2011—2013, with a further increase to 480 per year in 2014—2019. The share of mortgages issued for plots held or jointly registered by women increased from less than a quarter of new mortgages to over 60 percent of new mortgages. However, the evaluation was unable to find any changes in land investment or mortgages from land regularization. The project logic did not foresee changes in mortgages due to the bankability of the informal settlement households; however, there was an expectation for investment.One issue was the lack of comparability between the treatment and comparison areas for systematic land regularization. Comparison areas were more rural and began urbanizing and developing shortly after the compact, noting their prime reason for investment was to secure land. Sporadic registration and transfers climbed in these areas beginning in 2015. Treatment areas were more urbanized and invested ahead of land regularization due partially to criteria around land investment to obtain a program lease.

Economic Rate of Return

MCC considers a 10% economic rate of return (ERR) as the threshold to proceed with investment.- 18% Pre-investment

- 16% Project closeout

- 30.1% Evaluation-based ERR

MCC Learning

- Land legal, policy and institutional reforms combined with public awareness campaigns are key in driving land markets and access to credit. Often seen as an enabling factor, an effective land governance system can offer stand alone, wide-reaching and long-term benefits.

- Legal reform can be transformative in improving women’s land rights when changes in legislation are supported by complementary changes in regulations that ensure women’s legal rights are documented equally with those of men and by public awareness raising targeted at men and women.

- In areas with relatively strong perceptions of tenure, systematic land registration may not improve tenure perceptions and investment; land investment can in fact strengthen and secure tenure claims.

- Legal and institutional reform often requires a distinct evaluation methodology and sampling approach from the evaluation of clarification and recognition of land rights and boundaries. The beneficiary streams stemming from each differ yet their interactions with one another are key to understanding and capturing results.

Evaluation Methods

2021-002-2656