Program Overview

MCC’s $387.2 million Georgia Compact (2006-2011) funded the $32 million Georgia Regional Development Fund Activity, which was designed to catalyze small- and medium-enterprise (SME) development in the regions outside the capital Tbilisi, primarily in the agriculture and tourism sectors. The activity was based on the theory that providing $30 million in long-term risk capital and $2 million for technical assistance would increase the capacity, productivity, and profitability of selected SMEs, thereby boosting regional economic growth and employment.Evaluator Description

MCC commissioned A2F Consulting to conduct an independent final performance evaluation of the GRDF Activity. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/174.

Key Findings

Financial Performance

- The Georgia Regional Development Fund (GRDF) portfolio companies’ financial performance was mostly poor. The overall Internal Rate of Return was estimated at -14.22 percent.

- 12 out of a total of 14 GRDF investees ran into financial difficulties and fell behind on debt payments.

Development Returns

- The GRDF inconsistently impacted development returns: Only half of the 14 companies had positive returns, while the other seven were negative or zero.

Economic Growth and Employment

- Of the 14 GRDF investees, four were successful in boosting economic growth and employment in the regions outside Tbilisi, while another four eventually became insolvent. The remaining six showed mixed performance. Those that were successful were generally able to attract outside sources of private financing.

- GRDF investments helped create 3-4 transformational companies in Georgia with positive externalities. This confirms that private equity is well suited to provide patient capital and can be a market-friendly way of providing grants to countries.

Evaluation Questions

This final performance evaluation was designed to answer the following questions:- 1 Did GRDF meet its stated objectives?

- 2 What factors explain the success of the relatively more successful/profitable firms?

- 3 What barriers/challenges explain any underperformance noted in GRDF portfolio firms?

- 4 What were some indirect effects of GRDF investments?

- 5 To what extent has the GRDF investment been essential for SME development and for their access to finance?

- 6 Did GRDF provide financing that wouldn’t have been accessible otherwise?

Detailed Findings

Financial Performance

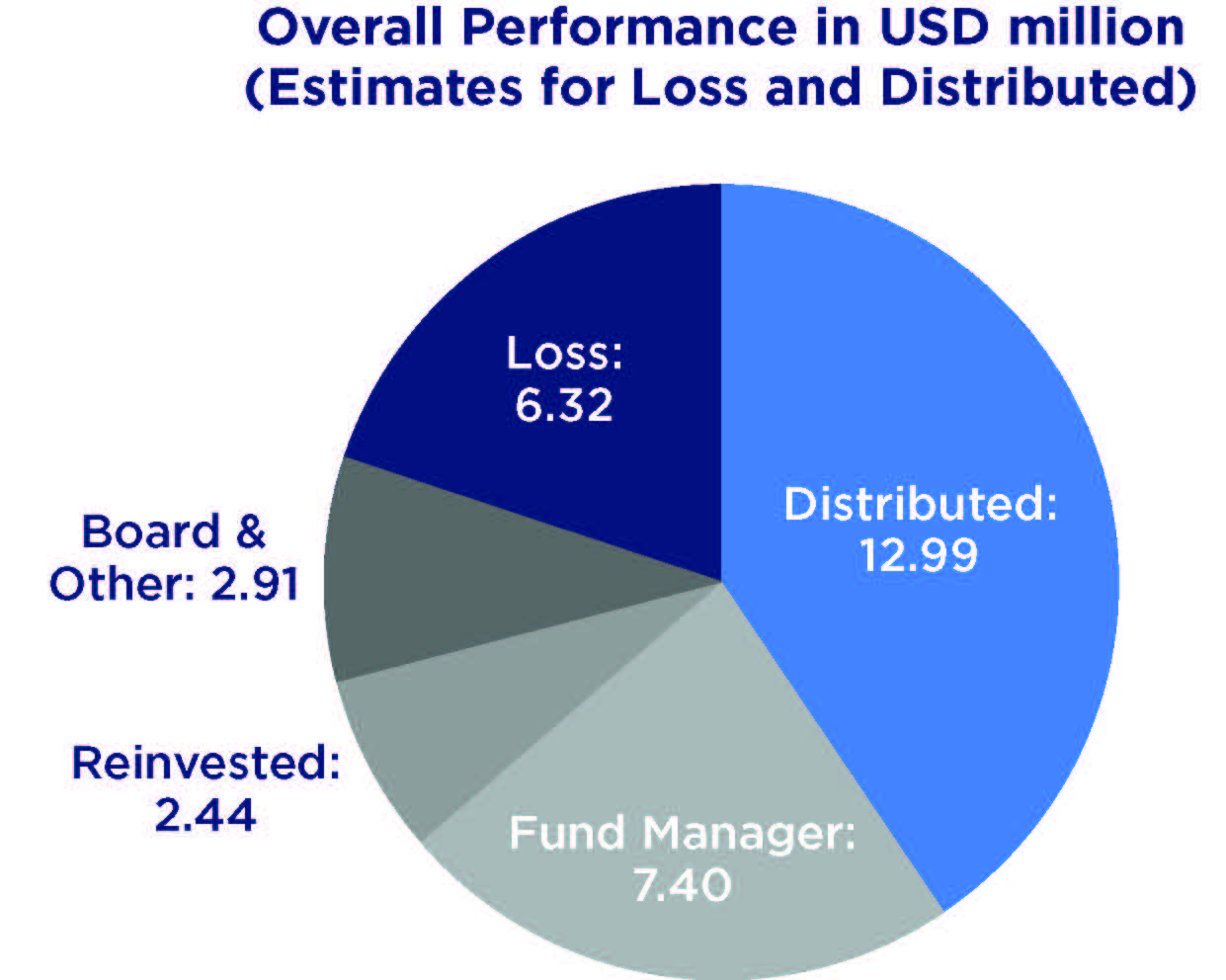

Most GRDF investees performed poorly from a financial perspective. All but two of the 14 GRDF investees ran into financial difficulties and fell behind on debt servicing payments. While these financial difficulties are rooted in business operations, GRDF financed relatively small enterprises with minimal operational history and no prior experience managing debt obligations. The debt accepted on balance sheets represented the largest source of capital. To service the high debt loans, the investees had to grow at high rates, leaving little room for error to reach optimistic growth numbers and margins of improvement. These performance problems were exacerbated by the volatile Georgian business environment and several external shocks, notably the financial crisis of 2007-2008 and the Russian incursion into Georgia in 2008. Investees in the priority sectors of agribusiness and tourism were among the worst performers in the GRDF portfolio due in part to these shocks.Including an adjusted $1.2 million in unrealized investments, GRDF returned $25.2 million out of $32.2 million in committed capital. GRDF losses totaled approximately $6.3 million. The overall net Internal Rate of Return resulted in a -14.22 percent return, which was derived after deducting $10 million in management and operating expenses.

Development Returns

GRDF invested in Madai Ltd., an anchovy fishing and fish processing enterprise to help purchase a new fleet and reallocate as well as expand its processing plant.

GRDF investment in Piunik helped the company transform into a major local producer of hatching eggs and day-old chicks, thereby providing local farmers a cost-effective alternative to imports.

Economic Growth and Employment

The GRDF was created against the backdrop of high unemployment and a credit-constrained financial sector. The GRDF catered to regional subject matter experts, particularly those in agribusiness and tourism, with the aim of catalyzing development and growth in regions outside Tbilisi. However, of the 14 GRDF investees, only four were successful in boosting economic growth and employment, while four eventually became insolvent and the remaining six showed mixed performance.Those that were successful were generally able to attract private financing. The largest recipient of outside private capital was Foodmart, which attracted over $30 million from reinvestment from existing shareholders. Even among the GRDF recipient companies that fell short of expectations, many are likely to improve operations and attract additional capital after GRDF. The largest recipient of outside private capital was Foodmart, which attracted over $30 million from reinvestment from existing shareholders. Even among the GRDF recipient companies that fell short of expectations, many are likely to continue to improve operations and attract additional capital after GRDF.

The GRDF was a pioneering initiative to promote regional development that, despite the many failed investments, helped spark the creation of several transformational companies. Piunik, for example, was able to reduce Georgia’s dependency on imports for hatching eggs. It has continued to grow by expanding local production and services and contributes to the positive development of the surrounding area. Delta Comm is a truly transformational business, connecting rural and urban areas alike, playing a leading role in fiber optic infrastructure development of the country and providing ancillary services. For those investments that struggled, it was not the GRDF concept itself, but structural issues with the design as well as inadequate performance of the board and fund manager on key aspects that contributed to poor outcomes.

Internal Rate of Return

- -5.92% Gross IRR of Portfolio Investments

- -14.22% Net IRR Incorporating Effect of Account Fund Management Expenses

The evaluator calculated an Internal Rate of Return (IRR) for each investment using the financial performance of each investment and an estimated fair market value of any unrealized returns (as of report publication). IRRs for each investment are found in Annex Three of the Final Evaluation Report.

MCC Learning

- Measuring and attributing non-financial outcomes of an investment fund proved to be difficult. Moreover, the emphasis on development return to determine a portion of the fund manager’s compensation incentivized short-term performance over long-term value creation and ultimately led the fund manager to take riskier investments that were not necessarily financially sustainable.

- The five-year time limit on MCC compacts creates a number of challenges in the design of investment funds. Even though it was extended ten years beyond the compact period, the GRDF encountered difficulties in liquidating its portfolio in a timely manner and the inability to intervene in the post-compact period introduced reputation and other risks.

- Potential synergies between compact components could have been more adequately exploited to increase the probability of success. Expanding the role and size of the Technical Assistance Facility may have helped improve business viability and build SME capacity prior to and during investment. Additionally, if the Agribusiness Development Activity was given more lead time to address the primary agriculture market, GRDF investments in the secondary agricultural market may have been more successful.

Evaluation Methods

Madai Ltd., an anchovy fishing and fish processing enterprise, improved operations as a result of GRDF investment.

The evaluation involved a document review, in-depth financial analysis, stakeholder interviews, and in-depth case studies. The companies selected for the case studies represented a cross-section of the portfolio in terms of financial and development performance.

Data collection occurred in 2016 in alignment with the closing of the Fund, ten years after the creation of the Fund and five years after the end of the compact. The exposure period ranged from 60-96 months.

2020-002-2441