Program Overview

MCC’s $277 million El Salvador Investment Compact aims to improve El Salvador’s competitiveness by increasing private investment through the $42 million Investment Climate Project—comprising the El Salvador Investment Challenge, Regulatory Improvement Activity, and Public-Private Partnerships (PPP) Activity. MCC’s $28 million Guatemala Threshold Program aims to catalyze private investment in infrastructure through its $4 million PPP Activity. MCC conducted one joint evaluation due to the two programs’ similar nature and geographic proximity.Download Spanish translated evaluation brief.

Evaluator Description

MCC commissioned Mathematica to conduct independent interim performance evaluations of the El Salvador Investment Climate Project and the Guatemala Public-Private Partnerships Activity. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/233.

Key Findings

PPP Support in El Salvador and Guatemala

- MCC’s PPP investments—consisting of PPP training, institution-specific coaching, and project-specific technical studies—have largely addressed stakeholder needs for capacity building and PPP development.

- Politics—more than technical or legal issues—constrain execution of MCC-supported PPP contracts.

El Salvador Investment Challenge

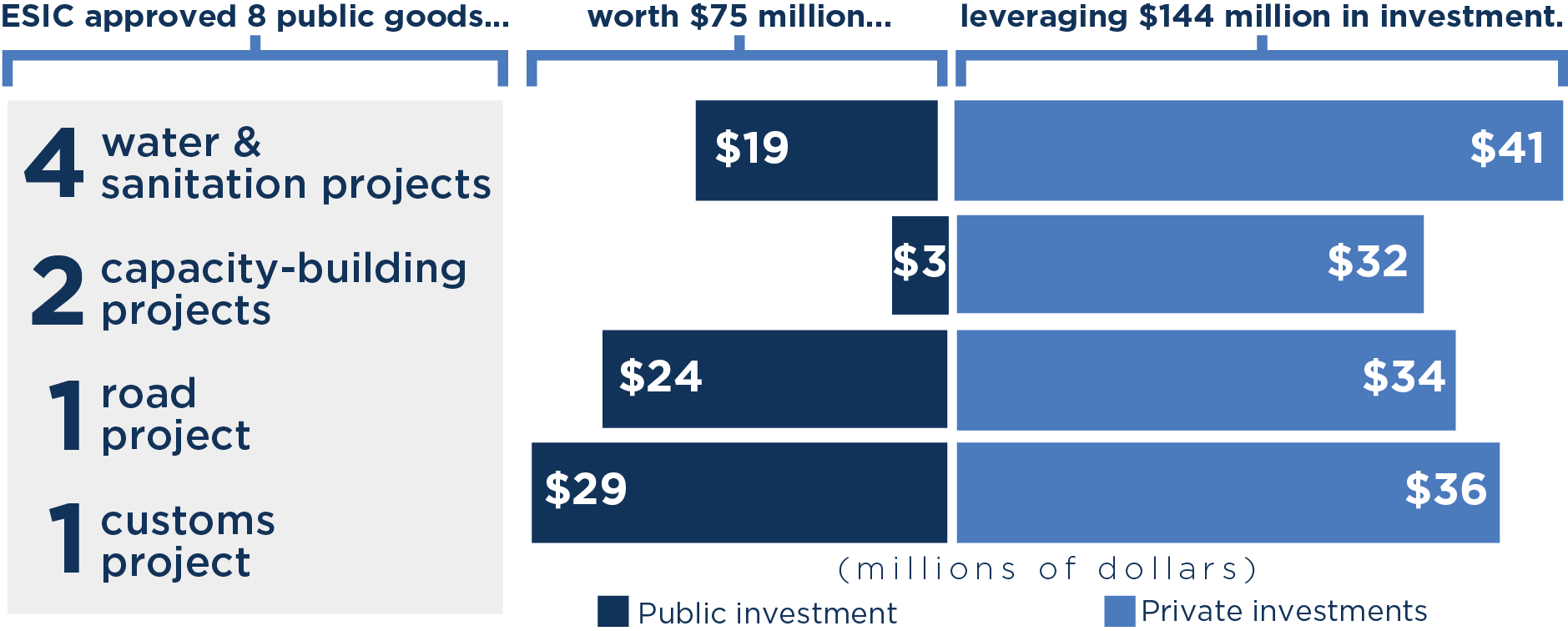

- By mid-2019, the project had committed $75 million to funding public goods, meeting its funding target.

- Although the project’s public goods have generated new private investment, the amount of investment directly attributable to the project is unclear.

Regulatory Improvement Activity in El Salvador

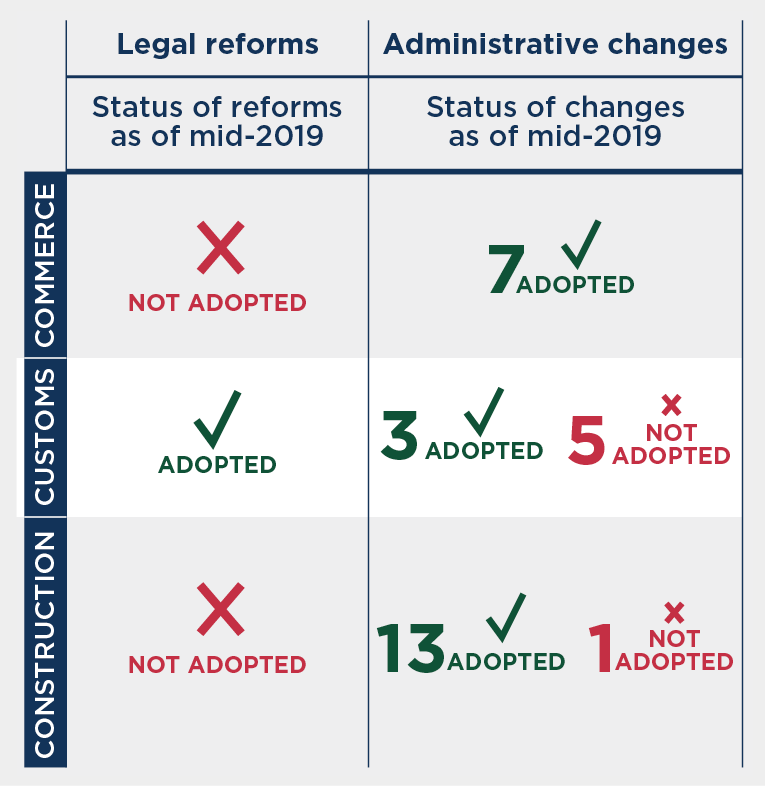

- During the project’s first three years, stakeholders achieved key legislative milestones toward the regulatory improvement system’s institutionalization.

- As of mid-2019, the newly established El Salvadoran Organization for Improved Regulation and its partner institutions had had mixed success in executing legal and administrative reforms.

Evaluation Questions

The interim evaluation report documented activity implementation and described early findings. Key evaluation questions included:- 1 How have MCC investments been implemented to date?

- 2 Are MCC investments on track to yield their intended results during the compact or threshold program period?

Detailed Findings

PPP Support in Guatemala and El Salvador

In El Salvador and Guatemala, PPP authorities and the Ministries of Finance used MCC-funded training and coaching to quickly build in-house capacity to assess PPPs’ technical, economic, financial, legal, environmental, and social viability. MCC support for technical studies also helped advance multiple transportation sector PPPs in both countries. However, no contracts for MCC-supported PPPs had been awarded by mid-2019 in either country.Coaching, capacity building, and technical assistance met most PPP-related needs in both countries. However, a lobbying component targeting key decision makers was lacking in both countries at the start of assistance. This lack may have impeded progress on MCC-supported PPPs in both countries, given PPPs’ politicized assessment and approval process.

El Salvador Investment Challenge

The El Salvador Investment Challenge’s initial process for attracting proposals from private investors was overly burdensome and complex. After simplifying the process and conducting strategic outreach to the private sector, the program attracted much stronger proposals. By 2019, the Investment Challenge had allocated nearly its entire budget of $75 million to eight public goods.

Public and private actors alike see the El Salvador Investment Challenge as an innovative approach to prioritizing public goods because it focuses decision making on generating shared benefits for communities and companies.

Regulatory Improvement Activity in El Salvador

MCC Learning

- The initial El Salvador Investment Challenge design and application process needed to be simpler and to better target the private sector.

- PPPs in both Guatemala and El Salvador and the Regulatory Improvement Activity in El Salvador need political champions. Without political champions to support PPPs or regulatory reform, progress is difficult, even if MCC provides adequate funds and technical assistance.

- A political economy analysis is critical to understanding PPPs and regulatory reform. Identifying key actors and power structures in PPPs and regulatory improvements was useful for an evaluation focused on institutional reform. Analyses of stakeholder interests and power helped predict each PPP’s likelihood of congressional approval.

Evaluation Methods

Minister of Finance of Guatemala, Victor Martinez Ruiz, participates in panel at Guatemala’s Public-Private Partnership Expo Convention in October 2019

For the first interim report, Mathematica used data from focus group discussions and interviews conducted in late 2018 and early 2019 (two to three years after intervention onset) with more than 80 individuals representing program implementers, relevant public authorities, and firms affected by MCC-funded activities. Mathematica used thematic coding and triangulation techniques to document and assess program implementation, identifying common and divergent themes across stakeholder types. Mathematica also used a political economy lens to assess implementation and early results.

For the final evaluation, Mathematica will collect another round of primary data and use administrative data from 5-6 years after intervention onset.

Next Steps

Exhibitor booth of ANADIE (Guatemala’s agency for public-private partnerships) at Guatemala’s Public-Private Partnership Expo Convention in October 2019

2020-002-2408