Program Overview

MCC’s $474 million Indonesia Compact (2013-2018) included a $288 million Green Prosperity (GP) Project that aimed to increase economic productivity and reduce land-based greenhouse gas emissions. The project funded 20 on-grid renewable energy (RE) grants totaling $10.6 million. These grants intended to reduce fossil fuel reliance by increasing the amount of RE supplied to the grid. 20 grants were approved; nine provided technical assistance (TA) only for feasibility work and 11 funded TA and infrastructure works. These 11 grants leveraged additional financing from the private sector. Only four of the 11 grants were completed, adding three megawatts of generation capacity with over $8 million in co-financing.Evaluator Description

MCC contracted Integra Government Services International to conduct an independent final performance evaluation of the GP Project’s on-grid renewable energy grants. Full report results and learning: https://data.mcc.gov/evaluations/index.php/catalog/238.

Key Findings

Implementation Fidelity

- GP Project delays significantly reduced the implementation time resulting in insufficient time to complete the grant requirements. A major change in government policy in 2017 meant that many grants without a signed power purchase agreement (PPA) were unlikely to get one in the time remaining for project completion.

Grant Completion

- Only four of the 11 grants were completed by the end of the project. This was due to the reduced implementation time and to the internal operations of the GP Project, where the process of reviewing and approving grant deliverables was neither organized nor implemented in an efficient manner designed to produce results.

Results

- Only one of the four completed grants sold power through a standard PPA, while the other three had a more limited excess PPA. Only two grants that did not reach completion were taken up by other investors.

Sustainability

- The four operating power plants were well maintained, indicating that the completed investments were sustainable. The sustainability of the CBS plans was mixed. The CBS plan at the three biogas plants was solidly implemented, embraced by the communities, and had a plan for sustainability. The hydro plant CBS was poorly implemented and many of the beneficiaries were unaware of how to access the plan or of the plan’s existence.

Evaluation Questions

This final performance evaluation was designed to answer a series of questions specifically about the on-grid renewable energy grant portfolio, including:- 1 Implementation Fidelity: Were on-grid renewable energy grants implemented as designed?

- 2 Grant Completion: Why did so few grants advance to completion? What can be learned about the selection of investments and/or about assessing their feasibility?

- 3 Results: Did GP Project support provide value to the grants that did not advance to completion? Are the independent power producers still selling power to the utility through a standard PPA? Have CBS plans been implemented effectively?

- 4 Sustainability: For the grants that were completed, is the infrastructure still operational? Are the CBS activities likely to be sustained? Is the operation likely to be maintained and sustained?

Detailed Findings

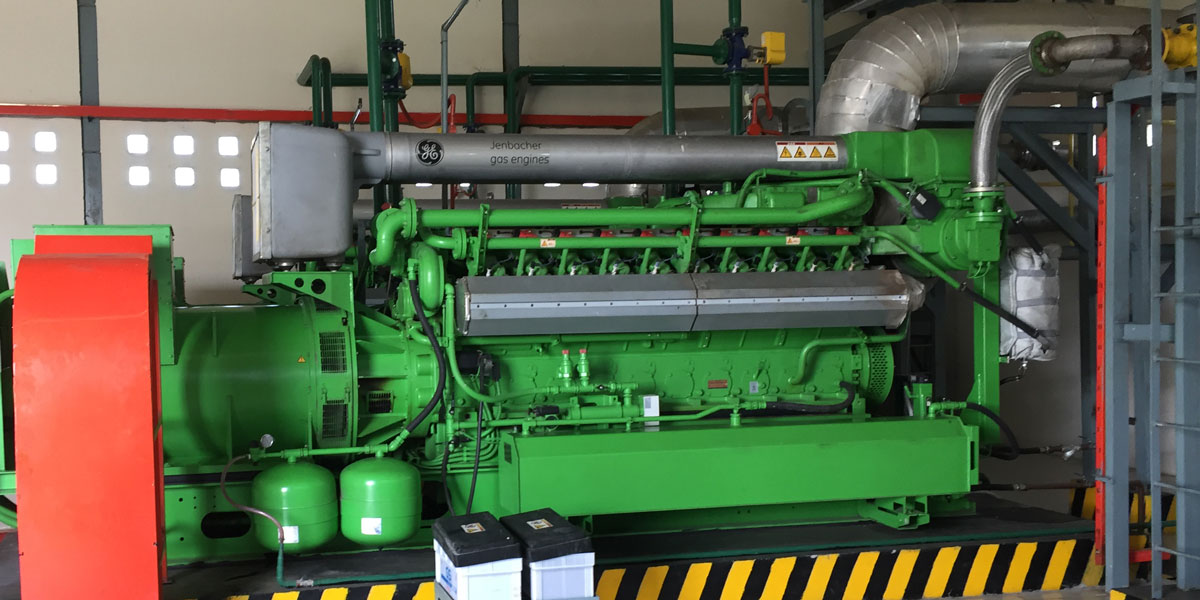

This power house was funded by one of the grants and is located near Sangar, West Padang Province.

Implementation Fidelity

Grants had less implementation time than planned. A delay of two years in awarding grants meant that projects had less than 27 months to complete the requirements (for example, a new hydro-project would take a minimum of 42 months). The compact required the Government of Indonesia to undertake policy measures that would increase the economic viability of RE. Yet, policy reversals in 2017 negatively impacted most grants that had not signed PPAs. For example, the feed-in tariffs were reduced in many areas and project ownership was required to be transferred to PLN (the state electricity company) at the end of the PPA. Both of these worked against new projects but a signed PPA prior to 2017 would have protected the grant applicant.

Grant Completion

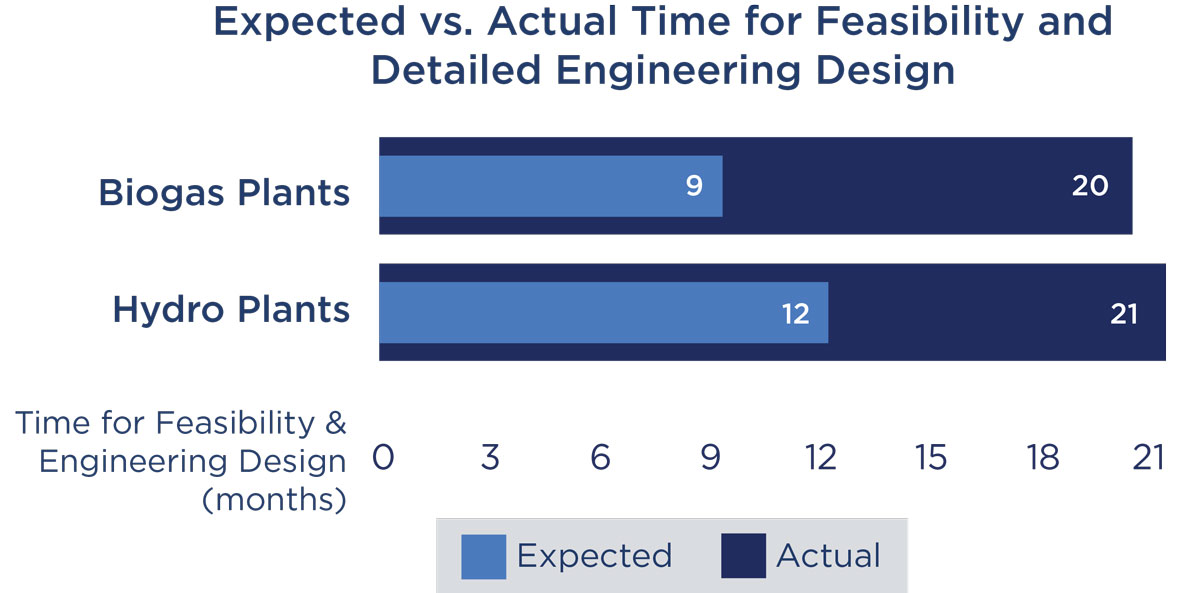

The reasons that only four grants were completed are internal to GP Project operations. Several factors contributed, including: (1) grants were awarded to projects that stood little likelihood of completing the requirements given the reduced implementation time. This included three full grants and six TA only grants that did not have signed PPAs; (2) grants that had a good likelihood of completion under routine development conditions suffered from the time it took to meet GP requirements. For example, based on GP documents, the average time for feasibility and detailed engineering design time should have been nine months for biogas plants and 12 for hydro plants. Yet, for the completed grants it took 20 months for biogas and 21 for hydro. These four grantees were successful power plant operators that already have a proven track record.

Results

Despite the lackluster performance of the GP facility in on-grid RE, there is a need for this kind of facility as grants can help move forward good projects.Value added of TA: Only three of the 16 incomplete grants claimed that the GP Project had added value. One small hydro said that it had improved at accessing international funds. The other hydro grant claimed it would find value in the experience only if there was another grant opportunity.

Subsequent completion of terminated grants: Only one terminated grantee had completed construction and sold power through an excess PPA. Grants that would not complete on time (by the end of the compact) were terminated before money could be spent on starting works.

CBS Plans: Communities were aware of and looked forward to the benefits of the CBS activities but had yet to see them directly. In the hydro grant, the local beneficiaries were unsure of how to access the CBS plan and the first disbursement did not follow the plan activities.

Sustainability

Maintenance: The investment in the four completed grants appeared to be maintained and sustainable. All grantees had maintenance programs and sound economic reasons, because of their PPA or their environmental commitments, to keep the investments operationalCBS Plans: The sustainability of the CBS plans was mixed. The three biogas grants had an institutional structure and broad support of the community, as well as the desire of the company to keep them working. In the hydro grant, the CBS plan was well thought out, but it appeared to be poorly implemented.

Economic Rate of Return

- 27-30% MCC Original Estimate

- 13-42% Evaluation-Based Estimate

MCC Learning

- An on-grid RE grant facility does fill a need, but only if there is adequate time to screen, select, and implement projects which would take most of MCC’s five year timeline.

- Technical assistance provided as part of projects such as those funded by on-grid RE should be aligned more towards continued development of those projects and not as a screen/due diligence.

- A grant facility should use available information on project and MCA timelines to screen projects. MCC is working on a leveraged grant facility guidance document that will help address these concerns.

- Grant facilities should ensure that a database of grant documentation and contact information exists in a form that is navigable by an independent evaluator in order to facilitate evaluation.

Evaluation Methods

The palm oil biogas engine is one of the engines purchased through a grant. This one is location in Rokan Hilir district of Riau Province. Bahana Nusa Interindo Palm Oil plant.

A palm oil methane effluent capture power plant funded by a Green Prosperity Project grant in Riau Province.

- 36 key informant interviews, including with MCA-Indonesia staff, MCC staff, GP contractors, local and national Indonesian Government representatives, and completed and terminated grantees.

- 10 focus group discussions with over 100 individuals from the beneficiary communities to discuss the CBS plans and implementation.

- Observations at four completed grant sites in West Sumatra and Riau provinces.