Introduction

The Millennium Challenge Corporation (MCC) is an independent U.S. Government agency with the mission to reduce poverty in developing countries through sustainable economic growth.

Each year, the MCC Board of Directors (Board) selects countries as eligible for MCC assistance. The selection process begins with the Board identifying candidate countries to consider; which, by law, are all countries with per capita incomes below the World Bank’s threshold between lower middle income countries and upper middle income countries that are not prohibited from receiving assistance by federal law. For a candidate country to then be selected as eligible to receive assistance, it must demonstrate a commitment to just and democratic governance, investing in its people, and economic freedom as measured by independent policy indicators. These indicators inform the Board of candidate countries’ broad policy framework for encouraging poverty reduction through economic growth.

These indicators are compiled into country scorecards. This is a guide to understanding and interpreting the indicators used on the country scorecards by MCC in Fiscal Year 2022. It provides an overview of the policies measured by the indicators, the relationship that these policies have to economic growth and poverty reduction, the methodologies used by the various indicator institutions to measure policy performance, descriptions of the underlying source(s) of data, and the contact information of the indicator institutions. This document also provides the specific information for how MCC constructs the final indicators from these sources. The scorecards produced using these indicators are available at: https://www.mcc.gov/who-we-fund/scorecards.

For general questions about the application of these indicators, please contact MCC’s Selection, Eligibility, and Policy Performance Division at DevelopmentPolicy@mcc.gov.

Indicators—What They Measure

The MCC scorecards measure performance on the policy criteria mandated in MCC’s authorizing legislation. By using information collected from independent third-party sources, MCC’s country selection process allows for an objective, comparable analysis across candidate countries.

MCC favors indicators that:

- are developed by an independent third party,

- use an analytically-rigorous methodology and objective, high-quality data,

- are publicly available,

- have broad country-coverage among MCC candidate countries,

- are comparable across countries,

- have a clear theoretical or empirical link to economic growth and poverty reduction,

- are policy-linked, i.e. measure factors that governments can influence, and

- have appropriate consistency in results from year to year.

Ruling Justly

These indicators measure just and democratic governance, including a country’s demonstrated commitment to promoting political pluralism, equality, and the rule of law; respecting human and civil rights; protecting private property rights; encouraging transparency and accountability of government; and combating corruption.

- Political Rights – Independent experts rate countries on: the prevalence of free and fair elections of officials with real power; the ability of citizens to form political parties that may compete fairly in elections; freedom from domination by the military, foreign powers, totalitarian parties, religious hierarchies and economic oligarchies; and the political rights of minority groups, among other things. Source: Freedom House

- Civil Liberties – Independent experts rate countries on: freedom of expression; association and organizational rights; rule of law and human rights; and personal autonomy and economic rights, among other things. Source: Freedom House

- Control of Corruption – An index of surveys and expert assessments that rate countries on: “grand corruption” in the political arena; the frequency of petty corruption; the effects of corruption on the business environment; and the tendency of elites to engage in “state capture,” among other things. Source: World Bank/Brookings Institution’s Worldwide Governance Indicators

- Government Effectiveness – An index of surveys and expert assessments that rate countries on: the quality of public service provision; civil servants’ competency and independence from political pressures; and the government’s ability to plan and implement sound policies, among other things. Source: World Bank/Brookings Institution’s Worldwide Governance Indicators

- Rule of Law – An index of surveys and expert assessments that rate countries on: the extent to which the public has confidence in and abides by the rules of society; the incidence and impact of violent and nonviolent crime; the effectiveness, independence, and predictability of the judiciary; the protection of property rights; and the enforceability of contracts, among other things. Source: World Bank/Brookings Institution’s Worldwide Governance Indicators

- Freedom of Information – Measures the legal and practical steps taken by a government to enable or allow information to move freely through society; this includes measures of press freedom, national freedom of information laws, and the extent to which a country is shutting down the internet or social media. Source: Access Now / Centre for Law and Democracy / Reporters Without Borders

Investing in People

These indicators measure investments in the promotion of broad-based primary education, strengthened capacity to provide quality public health, the reduction of child mortality, and the sustainable management of natural resources.

- Immunization Rates – The average of DPT3 and measles immunization coverage rates for the most recent year available. Source: WHO and the United Nations Children’s Fund (UNICEF)

- Public Expenditure on Health – Total expenditures on health by government at all levels divided by gross domestic product (GDP). Source: The World Health Organization (WHO)

- Public Expenditure on Primary Education – Total expenditures on primary education by government at all levels divided by GDP. Source: The United Nations Educational, Scientific and Cultural Organization (UNESCO) Institute of Statistics and National Governments

- Girls’ Primary Education Completion Rate – The number of female students enrolled in the last grade of primary education minus repeaters divided by the population in the relevant age cohort (gross intake ratio in the last grade of primary). Source: UNESCO Institute of Statistics and National Governments

- Girls’ Secondary Education Enrollment Rate – The number of female pupils enrolled in lower secondary school, regardless of age, expressed as a percentage of the population of females in the theoretical age group for lower secondary education. Countries with a GNI per capita between $1,966 and $4,095 will be assessed on this indicator instead of Girls Primary Completion Rates. Source: UNESCO Institute of Statistics and National Governments

- Child Health – An index made up of three indicators: access to improved water, access to improved sanitation, and child (ages 1-4) mortality. Source: The Center for International Earth Science Information Network and the Yale Center for Environmental Law and Policy

- Natural Resource Protection – Assesses whether countries are protecting up to 17 percent of all their biomes (e.g., deserts, tropical rainforests, grasslands, savannas and tundra). Source: The Center for International Earth Science Information Network and the Yale Center for Environmental Law and Policy

Encouraging Economic Freedom

These indicators measure the extent to which a government encourages economic freedom, including a demonstrated commitment to economic policies that: encourage individuals and firms to participate in global trade and international capital markets, promote private sector growth and strengthen market forces in the economy.

- Regulatory Quality – An index of surveys and expert assessments that rate countries on: the burden of regulations on business; price controls; the government’s role in the economy; and foreign investment regulation, among other areas. Source: World Bank/Brookings Institution’s Worldwide Governance Indicators

- Land Rights and Access – An index that rates countries on the extent to which the institutional, legal, and market framework provides secure land tenure and equitable access to land in rural areas and the extent to which men and women have the right to private property in practice and in law. Pass: Score must be above the median score for the income group. Source: The International Fund for Agricultural Development and Varieties of Democracy Index

- Access to Credit – An index that ranks countries based on access and use of formal and informal financial services as measured by the number of bank branches and ATMs per 100,000 adults and the share of adults that have an account at a formal or informal financial institution. Pass: Score must be above the median score for the income group. Source: Financial Development Index (International Monetary Fund) and Findex (World Bank)

- Business Start-Up – An index that rates countries based on surveys of firms on the time to obtain an operating license and whether permits and licenses are the biggest obstacle to business. Pass: Score must be above the median score for the income group. Source: World Bank Enterprise Surveys

- Trade Policy – A measure of a country’s openness to international trade based on weighted average tariff rates and non-tariff barriers to trade. Source: The Heritage Foundation’s Index of Economic Freedom

- Inflation – The most recent average annual change in consumer prices. Source: The International Monetary Fund’s (IMF) World Economic Outlook Database

- Fiscal Policy – General government net lending/borrowing as a percent of GDP, averaged over a three-year period. Net lending/borrowing is calculated as revenue minus total expenditure. Source: The IMF’s World Economic Outlook Database

- Gender in the Economy – An index that measures the extent to which laws provide men and women equal capacity to generate income or participate in the economy, including factors such as the capacity to access institutions, get a job, register a business, sign a contract, open a bank account, choose where to live, to travel freely, property rights protections, protections against domestic violence, and child marriage, among others. Pass: Score must be above the median score for the income group. Source: Women, Business, and the Law (World Bank) and the WORLD Policy Analysis Center (UCLA)

Determining MCC Candidacy

For Fiscal Year 2022 (FY22), 81 countries meet the income parameters for MCC candidacy (with 66 being candidates and 15 meeting the income parameters but that are statutorily prohibited from receiving assistance). MCC creates scorecards for all 81 countries that meet the income parameters. A country is determined to be an MCC candidate if its per capita income falls within predetermined parameters set by Congress and it is not subject to certain restriction on U.S. foreign assistance. Those parameters are that the country must be classified as either low income or lower middle income by the World Bank (which means it is estimated to have a Gross National Income (GNI) per capita (Atlas Method) less than the World Bank’s lower middle income country threshold of $4,095 in FY22, as published in the World Bank’s July release of income data.[[And be considered an Independent State by the US Department of State.]] See the FY22 Candidate Country Report for additional information.

Setting the Scorecard Income Groups

For FY22, MCC is continuing to use the historical ceiling for eligibility as set by the World Bank’s International Development Association (IDA) (often referred to as the ‘Historical IDA Threshold’) to divide the 81 countries into two income groups for the purpose of comparative analysis on the scorecard policy performance indicators. These two income groups are: 1) countries whose GNI per capita is less than or equal to $1,965 in FY22 and 2) those countries whose GNI per capita falls between $1,966 and $4,095 in FY22. For additional information, see the FY22 Selection Criteria and Methodology Report.

Indicator Performance

A country is considered to “pass” a given indicator if it performs better than the median score in its income group or the absolute threshold (for certain indicators – see below). A country is considered to “pass” the scorecard if it: (i) “passes” at least ten of the 20 indicators; (ii)“passes” the Control of Corruption indicator; and, (iii) “passes” either the Civil Liberties or Political Rights indicator. For technical specifics regarding how these medians are calculated see the Note on Calculating Medians at the end of this document. Indicators with absolute thresholds in lieu of a median include:

- Inflation, on which a country’s inflation rate must be under a fixed ceiling of 15 percent;

- Immunization Rates, on which a country must have immunization coverage above 90% or the median, whichever is lower;

- Political Rights, on which countries must score above 17; and

- Civil Liberties, on which countries must score above 25.

The Board also takes into consideration whether a country performs substantially worse in any category (Ruling Justly, Investing in People, or Economic Freedom) than it does on the overall scorecard. While the indicator methodology is the predominant basis for determining which countries will be eligible for MCA assistance, the Board also considers supplemental information and takes into account factors such as time lags and gaps in the data used to determine indicator scores.

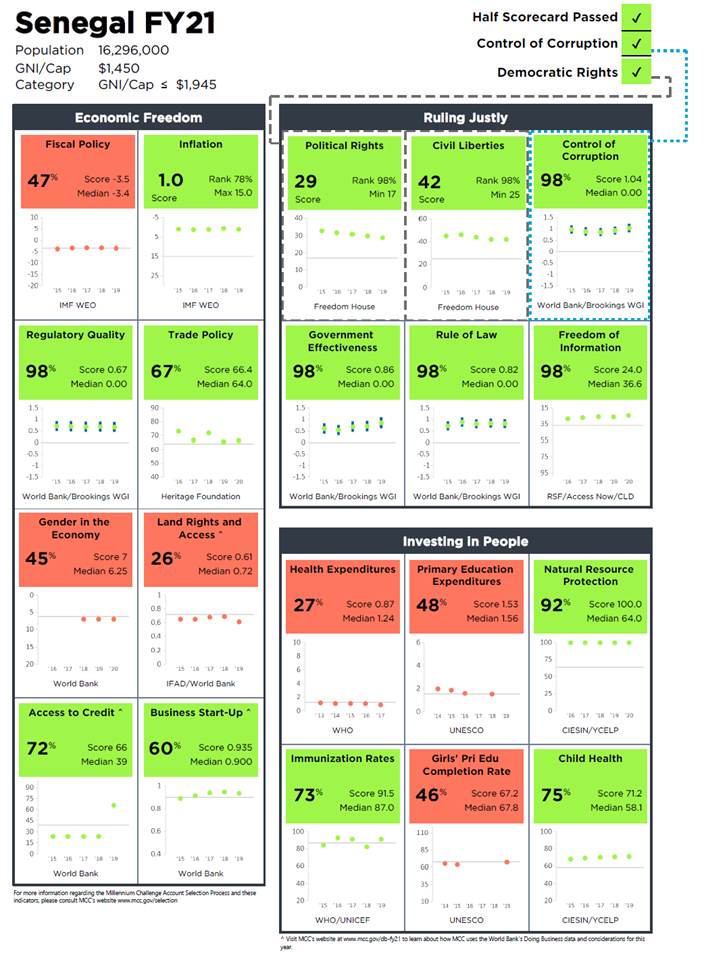

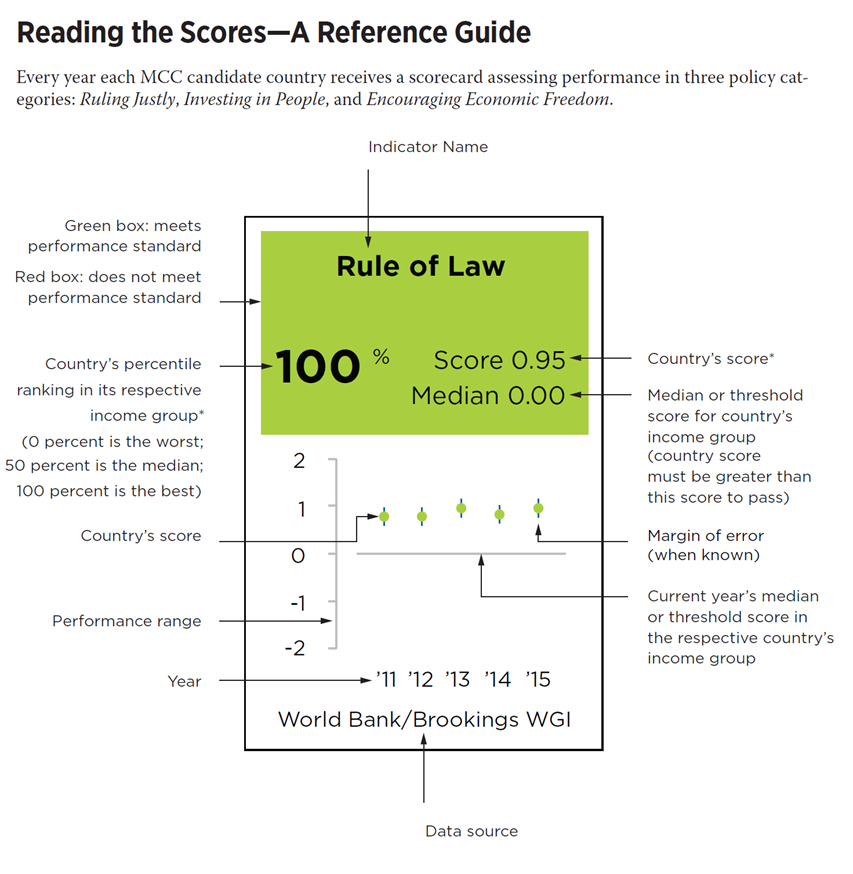

Example Scorecard

For reference, this is an example of a scorecard from FY21 and a guide for reading each of the indicators.

Senegal FY 21 Scorecard

A reference for reading MCC scorecards.

*For the Political Rights, Civil Liberties, Inflation, and Immunization Rates (when the median is over 90% immunized) indicators, the score and percent ranking are reversed due to those indicators operating on a minimum or maximum-score system rather than a median based system.

Ruling Justly Category

The six indicators in this category measure just and democratic governance by assessing, among other things, a country’s demonstrated commitment to promote political pluralism, equality, and the rule of law; respect human and civil rights, including the rights of people with disabilities; protect private property rights; encourage transparency and accountability of government; and combat corruption.

Political Rights Indicator

This indicator measures country performance on the quality of the electoral process, political pluralism and participation, government corruption and transparency, and fair political treatment of ethnic groups.

Countries are rated on the following factors:

- free and fair executive and legislative elections; fair polling; honest tabulation of ballots;

- fair electoral laws; equal campaigning opportunities;

- the right to organize in different political parties and political groupings; the openness of the political system to the rise and fall of competing political parties and groupings;

- the existence of a significant opposition vote; the existence of a de facto opposition power, and a realistic possibility for the opposition to increase its support or gain power through elections;

- the participation of cultural, ethnic, religious, or other minority groups in political life;

- freedom from domination by the military, foreign powers, totalitarian parties, religious hierarchies, economic oligarchies, or any other powerful group in making personal political choices; and

- the openness, transparency, and accountability of the government to its constituents between elections; freedom from pervasive government corruption; government policies that reflect the will of the people.

Relationship to Growth and Poverty Reduction

Although the relationship between democracy and economic growth is complex, research suggests that the institutional structures of democracy can promote growth by increasing policy stability, cultivating higher rates of human capital accumulation, reducing levels of income inequality and corruption, and encouraging higher rates of investment.[[Rodrik, D. and Roman Wacziarg. 2005. Do Democratic Transitions Produce Bad Economic Outcomes? American Economic Review Papers and Proceedings 95(2): 50-55. Rodrik, Dani. 2000. Participatory Politics, Social Cooperation, and Economic Stability. American Economic Review Papers and Proceedings 90(2): 140-144. Rigobon, Roberto and Dani Rodrik 2005. Rule of Law, Democracy, Openness and Income: Estimating the Interrelationships. Economics of Transition 13(3): 533- 564. Helliwell, J. 1994. Empirical linkages between democracy and economic growth. British Journal of Political Science April 24(2): 225. Baum, Matthew A., and David A. Lake. 2003. The Political Economy of Growth: Democracy and Human Capital. American Journal of Political Science 47(2): 333-347. Wacziarg, R. and José Tavares. 2001. How Democracy Affects Growth. European Economic Review 45(8): 1341-1379. Lederman, Daniel, Norman Loayza, and Rodrigo Soares. 2005. Accountability and Corruption: Political Institutions Matter. Economics and Politics 17(1): 1-35. Clague, C., Keefer, P., Knack, S., and M. Olson. 1996. Property and contract rights in autocracies and democracies. Journal of Economic Growth 1(2): 243-276. Henisz, Witold J. 2000. The Institutional Environment for Economic Growth. Economics and Politics 12(1): 1-31. Zweifel, Thomas D., and Patricio Navia. 2000. Democracy, Dictatorship, and Infant Mortality. Journal of Democracy 11:99-114. Brown, David. 1999. Reading, Writing, and Regime Type: Democracy’s Impact on School Enrollment. Political Research Quarterly 52(4): 681-707. Stasavage, David. 2005. The Role of Democracy in Uganda's Move to Universal Primary Education. Journal of Modern African Studies 43(1): 53-73. Stasavage, David. 2005. Democracy and Education Spending in Africa. American Journal of Political Science 49(2): 343-358. Brown, David and Wendy Hunter. 2004. Democracy and Human Capital Formation: Education Spending in Latin America, 1980-1997. Comparative Political Studies 37(7): 842-864. Farzin, Y. Hossein, and Craig A. Bond. 2006. Democracy and environmental quality Journal of Development Economics 81(1): 213– 235. McGuire, J.W. 2006. Democracy, Basic Service Utilization, and Under-5 Mortality: A Cross-National Study of Developing States. World Development 34(3):405–25. Ahlquist, J.S. 2006. Economic policy, institutions, and capital flows: portfolio and direct investment flows in developing countries. International Studies Quarterly 50(3): 681-704. Jensen, Nathan. 2003. Democratic Governance and Multinational Corporations. International Organization 57(3): 587-616. Henisz, Witold J. 2000. The Institutional Environment for Multinational Investment Journal of Law, Economics and Organization 16 (2): 334-364. Tsebelis, George. 1995. Decision Making in Political Systems: Veto Players in Presidentialism, Parliamentarism, Multicameralism, and Mulitpartyism. British Journal of Political Science 25(3): 289–325. Henisz, Witold J. 2004. Political Institutions and Policy Volatility. Economics and Politics 16(1): 1-27. Rodrik, Dani. 1999. Where Did All the Growth Go? External Shocks, Social Conflict, and Growth Collapses Journal of Economic Growth 4(4): 385– 412. Rivera-Batiz, Francisco L. 2002. Democracy, Governance, and Economic Growth: Theory and Evidence. Review of Development Economics 6(2): 225-47. Besley, Tim, Torsten Persson, and Daniel Sturm. 2006. Political Competition and Economic Performance: Theory and Evidence from the United States. NBER Working Paper No. 11484.]] The links between political rights and poverty reduction are similarly complicated, but there is evidence that democratic institutions are better at reducing economic volatility and provide a more consistent approach to poverty reduction than do autocratic regimes.[[Varshney, Ashtosh. 2000. Why Have Poor Democracies Not Eliminated Poverty? A Suggestion. Asian Survey 40(5): 718-736. Persson, Torsten and Guido Tabellini. Democracy and Development: the Devil in the Details. NBER working paper 11993. January 2006. Halperin, Morton H, Joseph T. Seigle, and Michael M. Weinstein. 2005. The Democracy Advantage: How Democracies Promote Prosperity and Peace. New York: Routledge. Rodrik, D. and Roman Wacziarg. 2005. Do Democratic Transitions Produce Bad Economic Outcomes? American Economic Review Papers and Proceedings 95(2): 50-55. Quinn, Dennis, and John Woolley. 2001. Democracy and National Economic Performance: The Preference for Economic Stability. American Journal of Political Science 45(3). Jalan, Jyotsna, and Martin Ravallion. 1999. Are the Poor Less Well Insured: Evidence on Vulnerability to Income Risk in Rural China. Journal of Development Economics 58(1): 61-82.]] Research also links the incentive structure of democratic institutions with outcomes favorable for the poor.[[Bueno de Mesquita, Bruce, Alastair Smith, Randolph M. Siverson, and James D. Morrow. 2003. The Logic of Political Survival. Cambridge, Mass.: MIT Press. Besley, Timothy and Robin Burgess. 2002. The Political Economy of Government Responsiveness: Theory and Evidence From India. Quarterly Journal of Economics. 117(4): 1415–451. Hirschman, Albert O. 1970. Exit, Voice, and Loyalty: Responses to Decline in Firms, Organizations, and States. Cambridge, Mass.: Harvard University Press. Paul, Samuel. 1992. Accountability in Public Services: Exit, Voice and Control. World Development 20(7): 1047-1060. There is also some empirical evidence linking democratic institutions to poverty reduction. See Li, H., Squire, L., and H. Zou. 1998. Explaining International and Intertemporal Variations in Income Inequality. Economic Journal 108: 26-43. Dollar, David and Aart Kraay. 2002. Growth is Good for the Poor. Journal of Economic Growth 7: 195-225. Arimah, Ben C. 2004. Poverty Reduction and Human Development in Africa. Journal of Human Development 5(3): 399-415. Kosack, S. 2003. Effective Aid: How Democracy Allows Development Aid to Improve the Quality of Life. World Development 31(1): 1-22.]]

Source

Freedom House, http://www.freedomhouse.org. Questions regarding this indicator may be directed to info@freedomhouse.org or +1 (212) 514-8040.

Indicator Institution Methodology

The Political Rights indicator is based on a team of expert analysts and scholars evaluating countries using a ten question checklist grouped into the three subcategories: Electoral Process (3 questions), Political Pluralism and Participation (4 questions), and Functioning of Government (3 questions). Points are awarded to each question on a scale of 0 to 4, where 0 points represents the fewest rights and 4 represents the most rights. The highest number of points that can be awarded to the Political Rights checklist is 40 (or a total of up to 4 points for each of the 10 questions). There is also an additional, discretionary, political rights question which can subtract up to 4 points from a country’s score. The full list of questions included in Freedom House’s methodology may be found at: https://freedomhouse.org/reports/freedom-world/freedom-world-research-methodology.

In consultation with Freedom House, MCC considers countries with scores above 17 to be passing this indicator.

MCC Methodology

Freedom House publishes a 1-7 scale (where 7 is “least free” and 1 is “most free”) for Political Rights. Since its Freedom in the World 2006 report, Freedom House has also released data using a 0-40 scale for Political Rights (where 0 is “least free” and 40 is “most free”). Table 1 illustrates how the 1-7 scale used prior to Fiscal Year 2007 (FY07) corresponds to the new 0-40 scale.

| New Scale | Old Scale |

|---|---|

| 36-40 | 1 |

| 30-35 | 2 |

| 24-29 | 3 |

| 18-23 | 4 |

| 12-17 | 5 |

| 6-11 | 6 |

| 0-5 | 7 |

MCC adjusts the years on the x-axis of the Country Scorecards to correspond to the period of time covered by the Freedom in the World publication. For instance, FY22 Political Rights data come from Freedom in the World 2021 and are labeled as 2020 data on the scorecard (the year Freedom House is reporting on in its 2021 report.)

Civil Liberties Indicator

This indicator measures country performance on freedom of expression and belief, associational and organizational rights, rule of law and human rights, personal autonomy, individual and economic rights, and the independence of the judiciary.

Countries are rated on the following factors:

- freedom of cultural expression, religious institutions and expression, and academia;

- freedom of assembly and demonstration, of political organization and professional organization, and collective bargaining;

- independence of the media and the judiciary;

- freedom from economic exploitation;

- protection from police terror, unjustified imprisonment, exile, and torture;

- the existence of rule of law, personal property rights, and equal treatment under the law;

- freedom from indoctrination and excessive dependency on the state;

- equality of opportunity;

- freedom to choose where to travel, reside, and work;

- freedom to select a marriage partner and determine whether or how many children to have; and

- the existence of a legal framework to grant asylum or refugee status in accordance with international and regional conventions and system for refugee protection.

Relationship to Growth and Poverty Reduction:

Studies show that an expansion of civil liberties can promote economic growth by reducing social conflict, removing legal impediments to participation in the economy, encouraging adherence to the rule of law, enhancing protection of property rights, increasing economic rates of return on government projects, and reducing the risk of project failure.[[Pritchett, Lant H., Daniel Kaufmann, and Jonathan Isham. 1997. Civil Liberties, Democracy, and the Performance of Government Projects. World Bank Economic Review 11(2): 219. Clague, C., Keefer, P., Knack, S., and M. Olson. 1996. Property and contract rights in autocracies and democracies. Journal of Economic Growth 1(2): 243-276. Henisz, Witold J. 2000. The Institutional Environment for Economic Growth. Economics and Politics 12(1): 1-31. Rodrik, D. and Romain Wacziarg. 2005. Do Democratic Transitions Produce Bad Economic Outcomes? American Economic Review Papers and Proceedings 95(2): 50-55. Rodrik, Dani. 2000. Participatory Politics, Social Cooperation, and Economic Stability. American Economic Review Papers and Proceedings 90(2): 140-144. Rodrik, Dani. 2000. Institutions for High-Quality Growth: What They Are and How to Acquire Them. Studies in Comparative International Development 35(3): 3-31. Weingast, Barry. 1995. The Economic Role of Political Institutions: Market-Preserving Federalism and Economic Development. Journal of Law, Economics, and Organization 11: 1-31.]] Additional research has shown that civil liberties have a positive effect on domestic investment and productivity, increase the success of investments by international actors, enhance economic freedoms, and can bolster growth through the freedom of mobility for individuals.[[Blume, Lorens and Stefan Voigt. 2007. The Economic Effects of Human Rights. Kyklos,60(4): 509–538. Kaufmann, Daniel. 2004. Human Rights and Governance: The Empirical Challenge. Presented at the Human Rights and Development: Towards Mutual Reinforcement Conference, New York University Law School, New York City. Vega-Gordillo, Manuel and Jose A lvarez-Arce. 2003. Economic Growth and Freedom: A Causality Study. Cato Journal, 23(2): 190– 215. BenYishay, A. and Roger Betancourt. 2010. Civil Liberties and Economic Development. Journal of Institutional Economic.]]

Source

Freedom House, http:/www./freedomhouse.org. Questions regarding this indicator may be directed to info@freedomhouse.org or +1 (212) 514-8040.

Indicator Institution Methodology

A team of expert analysts and scholars evaluate countries on a 60-point scale – with 60 representing “most free” and 0 representing “least free.” The Civil Liberties indicator is based on a 15 question checklist grouped into four subcategories: Freedom of Expression and Belief (4 questions), Associational and Organizational Rights (3 questions), Rule of Law (4 questions), and Personal Autonomy and Individual Rights (4 questions). Points are awarded to each question on a scale of 0 to 4, where 0 points represents the fewest liberties and 4 represents the most liberties. The highest number of points that can be awarded to the Civil Liberties checklist is 60 (or a total of up to 4 points for each of the 15 questions). The full list of questions included in Freedom House’s methodology may be found at: https://freedomhouse.org/reports/freedom-world/freedom-world-research-methodology.

In consultation with Freedom House, MCC considers countries with scores above 25 to be passing this indicator.

MCC Methodology

Freedom House publishes a 1-7 scale (where 7 is “least free” and 1 is “most free”) for Civil Liberties. Since its Freedom in the World 2006 report, Freedom House has also released data using a 0-60 scale (where 0 is “least free” and 60 is “most free”) for Civil Liberties. Table 2 illustrates how the 1-7 scale used prior to FY07 corresponds to the new 0-60 scale.

| New Scale | Old Scale |

|---|---|

| 53-60 | 1 |

| 44-52 | 2 |

| 35-43 | 3 |

| 26-34 | 4 |

| 17-25 | 5 |

| 8-16 | 6 |

| 0-7 | 7 |

MCC adjusts the years on the x-axis of the Country Scorecards to correspond to the period of time covered by the Freedom in the World publication. For instance, FY22 Civil Liberties data come from Freedom in the World 2021 and are labeled as 2020 data on the scorecard (the year Freedom House is reporting on in its 2021 report).

Control of Corruption Indicator

This indicator measures the extent to which public power is exercised for private grain, including both petty and grand forms of corruption, as well as “capture” of the state by elites and private interests. It also measures the strength and effectiveness of a country’s policy and institutional framework to prevent and combat corruption.

Countries are evaluated on the following factors:

- The prevalence of grand corruption and petty corruption at all levels of government;

- The effect of corruption on the “attractiveness” of a country as a place to do business;

- The frequency of “irregular payments” associated with import and export permits, public contracts, public utilities, tax assessments, and judicial decisions;

- Nepotism, cronyism and patronage in the civil service;

- The estimated cost of bribery as a share of a company’s annual sales;

- The perceived involvement of elected officials, border officials, tax officials, judges, and magistrates in corruption;

- The strength and effectiveness of a government’s anti-corruption laws, policies, and institutions;

- Public trust in the financial honesty of politicians;

- The extent to which:

- processes are put in place for accountability and transparency in decision-making and disclosure of information at the local level;

- government authorities monitor the prevalence of corruption and implement sanctions transparently;

- conflict of interest and ethics rules for public servants are observed and enforced;

- the income and asset declarations of public officials are subject to verification and open to public and media scrutiny;

- senior government officials are immune from prosecution under the law for malfeasance;

- the government provides victims of corruption with adequate mechanisms to pursue their rights;

- the tax administrator implements effective internal audit systems to ensure the accountability of tax collection;

- the executive budget-making process is comprehensive and transparent and subject to meaningful legislative review and scrutiny;

- the government ensures transparency, open-bidding, and effective competition in the awarding of government contracts;

- there are legal and functional protections for whistleblowers, anti-corruption activists, and investigators;

- allegations of corruption at the national and local level are thoroughly investigated and prosecuted without prejudice;

- government is free from excessive bureaucratic regulations, registration requirements, and/or other controls that increase opportunities for corruption;

- citizens have a legal right to information about government operations and can obtain government documents at a nominal cost.

Relationship to Growth and Poverty Reduction

Corruption hinders economic growth by increasing costs, lowering productivity, discouraging investment, reducing confidence in public institutions, limiting the development of small and medium-sized enterprises, weakening systems of public financial management, and undermining investments in health and education.[[Lambsdorff, Johann. 2003a. How Corruption Affects Persistent Capital Flows. Economics of Governance 4: 229-243. Lambsdorff, Johann. 2003b. How Corruption Affects Productivity. Kyklos 56: 457-474. Pellegrini, L. and R. Gerlagh. 2004. Corruption’s effect on growth and its transmission channels. Kylos 57(3): 429-456. Fisman, Raymond and Jakob Svensson. 2007. Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics 83: 63–75. Friedman, Eric, Simon Johnson, Daniel Kaufmann, and Pablo Zoido-Lobaton 2000. Dodging the Grabbing Hand: The Determinant of Unofficial Activity in 69 Countries. Journal of Public Economics 76: 459-493. Mauro, Paolo 1995. Corruption and Growth. Quarterly Journal of Economics 110:681-712. Kaufmann, Daniel, and Aart Kraay. 2002. Growth without Governance. Economia 3: 169-229. Ciocchini, Francisco, Erik Durbin, and David T.C. Ng. 2003. Does Corruption Increase Emerging Market Bond Spreads? Journal of Economics and Business 55: 503-528. Anderson, Christopher J., and Yuliya V. Tverdova. 2003. Corruption, Political Allegiances, and Attitudes Toward Government in Contemporary Democracies. American Journal of Political Science 47: 91-109. Abed, George T. and Sanjeev Gupta (eds.). 2002. Governance, Corruption and Economic Performance. Washington D.C.: International Monetary Fund. Ades, Alberto, and Rafael Di Tella. 1999. Rents, Competition, and Corruption. American Economic Review 89 (4): 982-993. Li. Hongyi, Lixin Colin Xu, and Heng-Fu Zou 2000. Corruption, Income Distribution, and Growth. Economics and Politics 12:155-182. Johnson, Simon, Daniel Kaufmann, John McMillan, and Christopher Woodruff. 2000. Why do firms hide? Bribes and unofficial activity after communism. Journal of Public Economics 76: 495-520. Wei, Shang-Jin. 2000. How Taxing is Corruption on International Investors? Review of Economics and Statistics 82:1-11. Del Monte, Alfredo, and Erasmo Papagni. 2001. Public Expenditure, Corruption, and Economic Growth: The Case of Italy. European Journal of Political Economy 17: 1-16.]] Corruption can also increase poverty by slowing economic growth, skewing government expenditure in favor of the rich and well-connected, concentrating public investment in unproductive projects, promoting a more regressive tax system, siphoning funds away from essential public services, adding a higher level of risk to the investment decisions of low-income individuals, and reinforcing patterns of unequal asset ownership, thereby limiting the ability of the poor to borrow and increase their income.[[Gupta, Sanjeev, Hamid R. Davoodi, and Rosa Alonso-Terme. 2002. Does Corruption Affect Income Inequality and Poverty? Economics of Governance 3: 23-45. Ravallion, M., and S. Chen. 1997. What Can New Survey Data Tell Us About Recent Changes in Distribution and Poverty? World Bank Economic Review 11(2): 357–382Gupta, Sanjeev, Hamid R. Davoodi, and Erwin R. Tiongson. 2001. “Corruption and the Provision of Health Care and Education Services,” in The Political Economy of Corruption, edited by Arvind K. Jain. London: Routledge. Mauro, P. 1998. Corruption and the Composition of Government Expenditure. Journal of Public Economics 69: 263–279. Rajkumar, A.S. and V. Swaroop. 2002: Public Spending and Outcomes: Does. Governance Matter? World Bank Policy Research Working Paper 2840. Anderson, James, Daniel Kaufmann, Francesca Recanatini. 2003. Service Delivery, Poverty and Corruption—Common Threads from Diagnostic Surveys. Background paper for 2004 World Development Report. Washington DC: World Bank. Olken, Benjamin. 2006. Corruption and the Costs of Redistribution: Micro Evidence from Indonesia. Journal of Public Economics 90 (4-5): 853-870.]]

Source

Worldwide Governance Indicators (WGI) from the World Bank/Brookings Institution, http://info.worldbank.org/governance/wgi/. Questions regarding this indicator may be directed to wgi@worldbank.org or +1 (202) 473-4557.

Indicator Institution Methodology

The indicator is an index combining a subset of 22 different assessments and surveys, depending on availability, each of which receives a different weight, depending on its estimated precision and country coverage. The Control of Corruption indicator draws on data, as applicable, from the Country Policy and Institutional Assessments of the World Bank, the Asian Development Bank and the African Development Bank, the Afrobarometer Survey, the World Bank’s Business Environment and Enterprise Performance Survey, the Bertelsmann Foundation’s Bertelsmann Transformation Index, Global Insight’s Business Conditions and Risk Indicators, the Economist Intelligence Unit’s Country Risk Service, The University of Gothenburg’s European Quality of Government Index, Transparency International’s Global Corruption Barometer survey, the World Economic Forum’s Global Competitiveness Report, Global Integrity’s African Integrity Index (previously known as the Global Integrity Index), the Gallup World Poll, the International Fund for Agricultural Development’s Rural Sector Performance Assessments, the Latinobarometro Survey, Political Economic Risk Consultancy’s Corruption in Asia, Political Risk Service’s International Country Risk Guide, Vanderbilt University Americas Barometer Survey, the Institute for Management and Development’s World Competitiveness Yearbook, Varieties of Democracy’s Corruption Index, and the World Justice Project’s Rule of Law Index.

MCC Methodology

MCC Normalized Score = WGI Score - median score

For ease of interpretation, MCC has adjusted the median for each of the two scorecard income pools to zero for all of the Worldwide Governance Indicators. Country scores are calculated by taking the difference between actual scores and the median. For example, in FY21 the unadjusted median for the scorecard category of countries with a Gross National Income (GNI) per capita between $1,946 and $4,045 on Control of Corruption was -0.51 (note, in FY22, the GNI per capita range for this scorecard category is $1,966 to $4,095). In order to set the median at zero, MCC simply adds 0.51 to each country’s score (the same thing as subtracting a negative 0.51). Therefore, as an example, Angola’s FY21 Control of Corruption score, which was originally -1.05, was adjusted to -0.54.

The FY22 scores come from the 2021 update of the Worldwide Governance Indicators dataset and largely reflect performance in calendar year 2020. Since the release of the 2006 update of the Worldwide Governance Indicators, the indicators are updated annually. Each year, the World Bank and Brookings Institution also make minor backward revisions to the historical data. Prior to 2006, the World Bank released data every two years (1996, 1998, 2000, 2002 and 2004). With the 2006 release, the World Bank moved to an annual reporting cycle and provided additional historical data for 2003 and 2005.

Government Effectiveness Indicator

This indicator measures the quality of public services, the quality of the civil service and its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to its stated policies.

Countries are evaluated on the following factors:

- competence of civil service; effective implementation of government decisions; and public service vulnerability to political pressure;

- ability to manage political alternations without drastic policy changes or interruptions in government services;

- flexibility, learning, and innovation within the political leadership; ability to coordinate conflicting objectives into coherent policies;

- the efficiency of revenue mobilization and budget management;

- the quality of transportation infrastructure, telecommunications, electricity supply, public health care provision, and public schools; the availability of online government services;

- policy consistency; the extent to which government commitments are honored by new governments;

- prevalence of red tape; the degree to which bureaucratic delays hinder business activity;

- existence of a taxpayer service and information program, and an efficient and effective appeals mechanism;

- the extent to which:

- effective coordination mechanisms ensure policy consistency across departmental boundaries, and administrative structures are organized along functional lines with little duplication;

- the business processes of government agencies are regularly reviewed to ensure efficiency of decision making and implementation;

- political leadership sets and maintains strategic priorities and the government effectively implements reforms;

- hiring and promotion within the government is based on merit and performance, and ethical standards prevail;

- the government wage bill is sustainable and does not crowd out spending required for public services; pay and benefit levels do not deter talented people from entering the public sector; flexibility (that is not abused) exists to pay more attractive wages in hard-to-fill positions;

- government revenues are generated by low-distortion taxes; import tariffs are low and relatively uniform, export rebate or duty drawbacks are functional; the tax base is broad and free of arbitrary exemptions; tax administration is effective and rule-based; and tax administration and compliance costs are low;

- policies and priorities are linked to the budget; multi-year expenditure projections are integrated into the budget formulation process, and reflect explicit costing of the implications of new policy initiatives; the budget is formulated through systematic consultations with spending ministries and the legislature, adhering to a fixed budget calendar; the budget classification system is comprehensive and consistent with international standards; and off-budget expenditures are kept to a minimum and handled transparently;

- the budget is implemented as planned, and actual expenditures deviate only slightly from planned levels;

- budget monitoring occurs throughout the year based on well-functioning management information systems; reconciliation of banking and fiscal records is practiced comprehensively, properly, and in a timely way;

- in-year fiscal reports and public accounts are prepared promptly and regularly and provide full and accurate data; the extent to which accounts are audited in a timely, professional and comprehensive manner, and appropriate action is taken on budget reports and audit findings.

Relationship to Growth and Poverty Reduction

Countries with more effective governments tend to achieve higher levels of economic growth by obtaining better credit ratings and attracting more investment, offering higher quality public services and encouraging higher levels of human capital accumulation, putting foreign aid resources to better use, accelerating technological innovation, and increasing the productivity of government spending.[[Burnside, C. and David Dollar. 2000. Aid, Policies and Growth. American Economic Review 90(4): 847-868. Burnside, C. and David Dollar. 2000. “Aid, Growth, the Incentive Regime, and Poverty Reduction.” in The World Bank: Structure and Policies, edited by Christopher L. Gilbert and David Vines. Oxford: Oxford University Press. Brunetti, Aymo. 1998. Policy Volatility and Economic Growth: A Comparative, Empirical Analysis. European Journal of Political Economy 14: 35-52. Fatas, Antonio, and Ilian Mihov. 2005. Policy Volatility, Institutions and Economic Growth. INSEAD. Brunetti, A., Kisunko, G., and B. Weder. 1998. Credibility of rules and economic growth: evidence from a worldwide survey of the private sector. World Bank Economic Review 12, 353–384. Asteriou, Dimitrios, and Simon Price. 2005. Uncertainty, Investment and Economic Growth: Evidence from a Dynamic Panel. Review of Development Economics 9(2): 277-288. Sarte, P.-D. G. 2001. Rent-Seeking Bureaucracies and Oversight in a Simple Growth Model. Journal of Economic Dynamic and Control. 25: 1345-1365. Ayal, E., and G. Karras. 1996. Bureaucracy, investment, and growth. Economics Letters. 51(2): 233-259. Baum, Matthew A., and David A. Lake. 2003. The Political Economy of Growth: Democracy and Human Capital. American Journal of Political Science. 47: 333-347. Easterly, William, Jozef Ritzen, and Michael Woolcock. 2006. Social Cohesion, Institutions, and Growth. Economics & Politics 18(2): 103-120. Rauch, James E., and Peter B. Evans. 2000. Bureaucratic Structure and Bureaucratic Performance in Less Developed Countries. Journal of Public Economics 75: 49-71. Ayal, E., and G. Karras. 1996. Bureaucracy, investment, and growth. Economics Letters 51(2): 233-259. Corsi, Marcella, Andrea Gumina, and Carlo D’Ippoliti. 2006. eGovernment Economics Project (eGEP) Economic Model Final Version." eGovernment Unit, European Commission. Kaufmann, Daniel, and Aart Kraay. 2002. Growth without Governance. Economia 3: 169-229. Rajkumar, A.S. and V. Swaroop. 2002: Public Spending and Outcomes: Does. Governance Matter? World Bank Policy Research Working Paper 2840. Hall, Robert E. and Charles Jones. Why Do Some Countries Produce So Much More Output per Worker than Others? Quarterly Journal of Economics 114: 83-116. Keefer, Phillip and Steve Knack. Forthcoming. Boondoggles, Rent-seeking and Political Checks and Balances: Public Investment Under Unaccountable Governments. Review of Economics and Statistics. Evans, Peter and James Rauch. 1999. Bureaucracy and Growth: A Cross-National Analysis of the Effects of ‘Weberian’ State Structures on Economic Growth. American Sociological Review 64(5): 748-765.]] Efficiency in the delivery of public services also has a direct impact on poverty.[[Gupta, Sanjeev, Hamid R. Davoodi, and Rosa Alonso-Terme. 2002. Does Corruption Affect Income Inequality and Poverty? Economics of Governance 3: 23-45. Chong, Alberto and César Calderón. 2000. Institutional quality and poverty measures in a cross-section of countries. Economics of Governance 1(2): 123-135. Abed, George T. and Sanjeev Gupta (eds.). 2002. Governance, Corruption and Economic Performance. Washington D.C.: International Monetary Fund. Léautier, Frannie (ed.). 2006. Cities in a Globalizing World Governance, Performance, and Sustainability. Washington D.C.: World Bank.]] On average, countries with more effective governments have better educational systems and more efficient health care.[[Lewis, Maureen. 2006. Governance and Corruption in Public Health Care Systems. Center for Global Development Working Paper 78. Washington D.C.: Center for Global Development. Baldacci, E., Benedict Clements, Sanjeev Gupta and Qiang Cui. 2004. Social Spending, Human Capital and Growth in Developing Countries: Implications for Achieving the MDGs. IMF Working Paper 04/217.]] There is evidence that countries with independent, meritocratic bureaucracies do a better job of vaccinating children, protecting the most vulnerable members of society, reducing child mortality, and curbing environmental degradation.[[Lewis, Maureen. 2006. Governance and Corruption in Public Health Care Systems. Center for Global Development Working Paper 78. Washington D.C.: Center for Global Development. Esty, Daniel and Michael Porter. 2005. National environmental performance: an empirical analysis of policy results and determinants. Environment and Development Economics 10: 391–434.]] Countries with a meritocratic civil service also tend to have lower levels of corruption.[[Rauch, James E. 2001. Leadership Selection, Internal Promotion, and Bureaucratic Corruption in Less Developed Polities. Canadian Journal of Economics 34(1): 240–258. World Bank. 2003. Understanding Public Sector Performance in Transition Countries—An Empirical Contribution. Washington, D.C.: World Bank.]]

Source

Worldwide Governance Indicators (WGI) from the World Bank/Brookings Institution, http://info.worldbank.org/governance/wgi/. Questions regarding this indicator may be directed to wgi@worldbank.org or +1 (202) 473-4557.

Indicator Institution Methodology

The indicator is an index combining a subset of 16 different assessments and surveys, depending on availability, each of which receives a different weight, depending on its estimated precision and country coverage. The Government Effectiveness indicator draws on data, as applicable, from the Country Policy and Institutional Assessments of the World Bank, the African Development Bank and the Asian Development Bank, the Afrobarometer Survey, the World Bank’s Business Environment and Enterprise Performance Survey, the Bertelsmann Foundation’s Bertelsmann Transformation Index, Global Insight’s Business Conditions and Risk Indicators, Global Integrity’s African Integrity Index (previously known as the Global Integrity Index), the Economist Intelligence Unit’s Country Risk Service, The University of Gothenburg’s European Quality of Government Index, the World Economic Forum’s Global Competitiveness Report, the Gallup World Poll, the International Fund for Agricultural Development’s Rural Sector Performance Assessments, the Latinobarometro Survey, Political Risk Service’s International Country Risk Guide, and the Institute for Management and Development’s World Competitiveness Yearbook.

MCC Methodology

MCC Normalized Score = WGI Score - median score

For ease of interpretation, MCC has adjusted the median for each of the two scorecard income pools to zero for all of the Worldwide Governance Indicators. Country scores are calculated by taking the difference between actual scores and the median. For example, in FY21 the unadjusted median for the scorecard category of countries with a Gross National Income (GNI) per capita between $1,946 and $4,045 on Control of Corruption was -0.51 (note, in FY22, the GNI per capita range for this scorecard category is $1,966 to $4,095). In order to set the median at zero, MCC simply adds 0.51 to each country’s score (the same thing as subtracting a negative 0.51). Therefore, as an example, Angola’s FY21 Control of Corruption score, which was originally -1.05, was adjusted to -0.54.

The FY22 scores come from the 2021 update of the Worldwide Governance Indicators dataset and largely reflect performance in calendar year 2020. Since the release of the 2006 update of the Worldwide Governance Indicators, the indicators are updated annually. Each year, the World Bank and Brookings Institution also make minor backward revisions to the historical data. Prior to 2006, the World Bank released data every two years (1996, 1998, 2000, 2002 and 2004). With the 2006 release, the World Bank moved to an annual reporting cycle and provided additional historical data for 2003 and 2005.

Rule of Law Indicator

This indicator measures the extent to which individuals and firms have confidence in and abide by the rules of society; in particular, it measures the functioning and independence of the judiciary, including the police, the protection of property rights, the quality of contract enforcement, as well as the likelihood of crime and violence.

Countries are evaluated on the following factors:

- public confidence in the police force and judicial system; popular observance of the law; a tradition of law and order; strength and impartiality of the legal system;

- prevalence of petty crime, violent crime, and organized crime; foreign kidnappings; economic impact of crime on local businesses; prevalence of human trafficking; government commitment to combating human trafficking;

- the extent to which a well-functioning and accountable police force protects citizens and their property from crime and violence; when serious crimes do occur, the extent to which they are reported to the police and investigated;

- security of private property rights; protection of intellectual property; the accuracy and integrity of the property registry; whether citizens are protected from arbitrary and/or unjust deprivation of property;

- the enforceability of private contracts and government contracts;

- the existence of an institutional, legal, and market framework for secure land tenure; equal access to land among men and women; effective management of common property resources; equitable user-rights over water resources for agriculture and local participation in the management of water resources;

- the prevalence of tax evasion and insider trading; size of the informal economy;

- independence, effectiveness, predictability, and integrity of the judiciary; compliance with court rulings; legal recourse for challenging government actions; ability to sue the government through independent and impartial courts; willingness of citizens to accept legal adjudication over physical and illegal measures; government compliance with judicial decisions, which are not subject to change except through established procedures for judicial review;

- the independence of prosecutors from political direction and control;

- the existence of effective and democratic civilian state control of the police, military, and internal security forces through the judicial, legislative, and executive branches; the police, military, and internal security services respect human rights and are held accountable for any abuses of power;

- impartiality and nondiscrimination in the administration of justice; citizens are given a fair, public, and timely hearing by a competent, independent, and impartial tribunal; citizens have the right to independent counsel and those charged with serious felonies are provided access to independent counsel when it is beyond their means; low-cost means are available for pursuing small claims; citizens can pursue claims against the state without fear of retaliation;

- protection of judges and magistrates from interference by the executive and legislative branches; judges are appointed, promoted, and dismissed in a fair and unbiased manner; judges are appropriately trained to carry out justice in a fair and unbiased manner; members of the national-level judiciary must give reasons for their decisions; existence of a judicial ombudsman (or equivalent agency or mechanism) that can initiate investigations and impose penalties on offenders;

- law enforcement agencies are protected from political interference and have sufficient budgets to carry out their mandates; appointments to law enforcement agencies are made according to professional criteria; law enforcement officials are not immune from criminal proceedings;

- the existence of an independent reporting mechanism for citizens to complain about police actions; timeliness of government response to citizen complaints about police actions.

Relationship to Growth and Poverty Reduction

Judicial independence is strongly linked to growth as it promotes a stable investment environment.[[Henisz, Witold J. 2000. The Institutional Environment for Economic Growth. Economics and Politics 12(1): 1-31. Feld, Lars, and Voigt, Stefan. 2003. Economic growth and judicial independence: cross-country evidence using a new set of indicators. European Journal of Political Economy 19(3): 497-527.]] On average, business environments characterized by consistent policies and credible rules, such as secure property rights and contract enforceability, create higher levels of investment and growth.[[Brunetti, A., Kisunko, G.,Weder, B., 1998. Credibility of rules and economic growth: evidence from a worldwide survey of the private sector. World Bank Economic Review 12, 353–384. Rigobon, Roberto and Dani Rodrik 2005. Rule of Law, Democracy, Openness and Income: Estimating the Interrelationships. Economics of Transition 13(3): 533- 564. Knack, Steve, Chris Clague, Phil Keefer, and Mancur Olson. 1999. Contract-Intensive Money: Contract Enforcement, Property Rights, and Economic Performance. Journal of Economic Growth: 4: 185–211. Rodrik, Dani, Subramanian, Arvind, and Francesco Trebbi. 2004. Institutions Rule: The Primacy of Institutions Over Geography and Integration in Economic Development. Journal of Economic Growth 9(2): 131-165. Easterly, William, Jozef Ritzen, and Michael Woolcock. 2006. Social Cohesion, Institutions, and Growth. Economics and Politics 18(2): 103-120. Rodrik, D. (ed.) 2003. In Search of Prosperity: Analytic Narratives on Economic Growth. Princeton: Princeton University Press. North, D.C. 1981. Structure and Change in Economic History. New York: W. W. Norton & Co. Svensson, J. 1998. Investment, Property Rights and Political Instability: Theory and Evidence. European Economic Review 42(7): 1317-1341. Johnson, McMillan, and Woodruff. 2002. Property Rights and Finance. The American Economic Review 92(5): 1335-1356. Besley, Timothy. 1995. Property Rights and Investment Incentives: Theory and Evidence form Ghana. Journal of Political Economy 103(5): 905-93. Keefer, P., and S. Knack. 2002. Polarization, Politics, and Property Rights: Links between Inequality and Growth. Public Choice 111(1–2): 127–54. Mauro, Paolo. 1995. Corruption and Growth. Quarterly Journal of Economics, 110: 681-712. Hall, R., and C. Jones. 1999. Why Do Some Countries Produce So Much More Output per Worker than Others? Quarterly Journal of Economics 114: 83–116. Rodrik, Dani. 1999. Where Did All the Growth Go? External Shocks, Social Conflict, and Growth Collapses Journal of Economic Growth 4(4): 385– 412. Tornell, A., Velasco, A., 1992. The tragedy of the commons and economic growth: Why does capital flow from poor to rich countries. Journal of Political Economy 100: 1208-1231.]] Secure property rights and contract enforceability also have a positive impact on poverty by granting citizens secure rights to their own assets.[[Chong, Alberto and César Calderón. 2000. Institutional quality and poverty measures in a cross-section of countries. Economics of Governance 1(2): 123-135. Dollar, D and A. Kraay 2002. Growth is Good for the Poor. Journal of Economic Growth 7(3): 195-225. World Bank. 2005. Pro-Poor Growth in the 1990s: Lessons and Insights from 14 Countries. Washington D.C.: World Bank.]] Research shows that people who do not have the resources or the connections to protect their rights informally are usually in most need of formal protection through efficient legal systems.[[World Bank. 2003. Land Policies for Growth and Poverty Reduction. Washington D.C.: World Bank. Ghani, Ashraf. 2006. Economic development, poverty reduction, and the rule of law: Lessons from East Asia, successes and failures. High Level Commission on Legal Empowerment of the Poor. World Bank. 2006. Doing Business 2007: How to Reform. Washington D.C.: World Bank.]]

Source

Worldwide Governance Indicators (WGI) from the World Bank/Brookings Institution, http://info.worldbank.org/governance/wgi/. Questions regarding this indicator may be directed to wgi@worldbank.org or +1 (202) 473-4557.

Indicator Institution Methodology

The indicator is an index combining a subset of 22 different assessments and surveys, depending on availability, each of which receives a different weight, depending on its estimated precision and country coverage. The Rule of Law indicator draws on data, as applicable, from the Country Policy and Institutional Assessments of the World Bank, the African Development Bank and the Asian Development Bank, the Afrobarometer Survey, the World Bank’s Business Environment and Enterprise Performance Survey, the Bertelsmann Foundation’s Bertelsmann Transformation Index, Freedom House’s Nations in Transit report, Global Insight’s Business Conditions and Risk Indicators, the Economist Intelligence Unit’s Country Risk Service, The University of Gothenburg’s European Quality of Government Index, the World Economic Forum’s Global Competitiveness Report, Global Integrity’s African Integrity Index (previously known as the Global Integrity Index), the Gallup World Poll, the Heritage Foundation’s Index of Economic Freedom, the International Fund for Agricultural Development’s Rural Sector Performance Assessments, the Latinobarometro Survey, Political Risk Service’s International Country Risk Guide, the United States State Department’s Trafficking in Persons Report, Vanderbilt University’s Americas Barometer, Institute for Management and Development’s World Competitiveness Yearbook, Varieties of Democracy’s Liberal Component Index, and the World Justice Project’s Rule of Law Index.

MCC Methodology

MCC Normalized Score = WGI Score - median score

For ease of interpretation, MCC has adjusted the median for each of the two scorecard income pools to zero for all of the Worldwide Governance Indicators. Country scores are calculated by taking the difference between actual scores and the median. For example, in FY21 the unadjusted median for the scorecard category of countries with a Gross National Income (GNI) per capita between $1,946 and $4,045 on Control of Corruption was -0.51 (note, in FY22, the GNI per capita range for this scorecard category is $1,966 to $4,095). In order to set the median at zero, MCC simply adds 0.51 to each country’s score (the same thing as subtracting a negative 0.51). Therefore, as an example, Angola’s FY21 Control of Corruption score, which was originally -1.05, was adjusted to -0.54.

The FY22 scores come from the 2021 update of the Worldwide Governance Indicators dataset and largely reflect performance in calendar year 2020. Since the release of the 2006 update of the Worldwide Governance Indicators, the indicators are updated annually. Each year, the World Bank and Brookings Institution also make minor backward revisions to the historical data. Prior to 2006, the World Bank released data every two years (1996, 1998, 2000, 2002 and 2004). With the 2006 release, the World Bank moved to an annual reporting cycle and provided additional historical data for 2003 and 2005.

Freedom of Information Indicator

This indicator measures a government’s commitment to enable or allow information to move freely in society. It is a composite index that includes a measure of press freedom; the status of national freedom of information laws; and a measure of internet filtering.

Relationship to Growth and Poverty Reduction

Governments play a role in information flows; they can restrict or facilitate information flows within countries or across borders. Many of the institutions (laws, regulations, codes of conduct) that governments design are created to manage the flow of information in an economy.[[Islam, Roumeen. 2006. Does More Transparency Go Along With Better Governance? Economics and Politics, vol. 18, no. 2, pp 121-167]] Countries with better information flows often have better quality governance and less corruption.[[Ahrend, Rudiger. 2002. Press freedom, human capital and corruption. DELTA Working Paper No. 2002-11. Bhattacharyya, Sambi and Roland Hodler. 2012. Media freedom and democracy: Complements or substitutes in the fight against corruption? CSAE Working Paper WPS/2012-02. Brunetti, Ayno and Beatrice Weder. 2003. A free press is bad news for corruption. Journal of Public Economics. 87(7-8): 1801-1824. Chowdhury, Shyamal K. 2004. The effect of democracy and press freedom on corruption: an empirical test. Economics Letters. 85(1): 93-101. Dirienzi, Cassandra, Joyti Das, Kathrn T. Cort and Joh Burbridge Jr. 2011. Corruption and the Role of Information. Journal of International Business Studies Vol. 38, No. 2, pp. 320-332. Freille, Sebastian, M. Emranul Haque, and Richard Kneller. 2007. A contribution to the empirics of press freedom and corruption. European Journal of Political Economy. 23(4): 838-862. International Monetary Fund. 2001. IMF Survey Supplement 30, September, Washington, D.C. Islam, Roumeen. 2006. Does More Transparency Go Along with Better Governance? Economics and Politics Vol. 18, No. 2, pp 121-167. Neuman, L (ed). 2002. Access to Information: A Key to Democracy. Atlanta: The Carter Center. Reinikka, Ritva and Jakob Svensson. 2003. The power of information: Evidence from a newspaper campaign to reduce capture. World Bank Policy Research Working Paper No. 3239. Roy, Sanjukta. Media Development and Political Stability: An Analysis of sub-Saharan Africa. Washington, D.C.: The Media Map Project.]] Higher transparency and access to information have been shown to increase investment inflows because they enhance an investor’s knowledge of the behaviors and operations of institutions in a target economy; help reduce uncertainty about future changes in policies and administrative practices; contribute data and perspectives on how best an investment project can be initiated and managed; and allow for the increased coordination between social and political actors that typifies successful economic development.[[Arsenault, Amelia and Shawn Powers. 2010. Media Map: Review of Literature. Washington, D.C.: The Media Map Project. Coyne, Christopher J. and Peter T. Leeson. 2004. Read all about it! Understanding the role of media in economic development. Kyklos. 57(1): 21-44. DiRienzi, Cassandra, Jayoti Das, Kathryn T. Cort, and John Burbridge Jr. 2007. Corruption and the role of information. Journal of International Business Studies. 38(2): 320-332. Drabek, Zdenek and Warren Payne. 2002. The impact of transparency on foreign direct investment. Journal of Economic Integration. 17(4): 777-810. Gelos, R. Gaston and Shang-Jin Wei. 2002. Transparency and international investor behavior. National Bureau of Economic Research Working Paper No. 9260. Cambridge. Guseva, Marina, Mounira Nakaa, Anne-Sophie Novel, Kirsii Pekkala, Bachir Souberou, and Sami Stouli. 2008. Press Freedom and Development: An Analysis of Correlations between Freedom of the Press and the Different Dimensions of Development, Poverty, Governance and Peace. Paris: United Nations Educational Scientific and Cultural Organization. International Monetary Fund. 2001. IMF Survey Supplement 30. Washington, D.C.: International Monetary Fund. Neuman, L. (Ed.). 2002. Access to Information: A Key to Democracy. Atlanta: The Carter Center. Roumeen. 2006. Does more transparency go along with better governance? Economics and Politics. 18(2): 121-167. Roy, Sanjukta. 2011. Overview Report: Measuring Media Development. Washington, D.C.: The Media Map Project. Stiglitz, Joseph. 2002. Transparency in government. In R. Islam, S. Djankov & C. McLeish (Eds.), The Right to Tell: The Role of Mass Media in Economic Development (pp. 27-44). Washington, D.C.: The World Bank. Susman-Peña, Tara. 2012. Healthy Media, Vibrant Societies: How Strengthening the Media Can Boost Development in sub-Saharan Africa. Washington, D.C.: The Media Map Project.]] The right of access to information within government institutions also strengthens democratic accountability, promotes political participation of all, reduces governmental abuses, and leads to more effective allocation of natural resources.[[Ansari, M. M. 2008. Impact of right to information on development: A perspective on India’s recent experiences. Invited lecture at UNESCO World Headquarters. Paris, France. Bellver, Ana and Daniel Kaufmann. 2005. Transparenting transparency: Initial empirics and policy applications. Washington, D.C.: The World Bank. Besley, Timothy and Robin Burgess. 2000. The political economy of government responsiveness: Theory and evidence from India. Development Economics Discussion Paper DEDPS 28. London: Suntory and Toyota International Centres for Economics and Related Disciplines, London School of Economics and Political Science. Besley, Timothy, Robin Burgess, and Andrea Prat. 2002. Mass media and political accountability. In R. Islam, S. Djankov & C. McLeish (Eds.), The Right to Tell: The Role of Mass Media in Economic Development (pp. 45-60). Washington, D.C.: The World Bank. Norris, Pippa. 2008. The role of the free press in promoting democratization, good governance and human development. In M. Harvey (Ed.), Section 2 of Media Matters: Perspectives on Advancing Governance and Development from the Global Forum for Media Development. (pp. 66-75). Internews Europe. Roberts, Alasdair. 2002. Access to government information: An overview of issues. In Access to Information: A Key to Democracy. Atlanta: The Carter Center. Shirazi, Farid, Ojelanki Ngwenyama, and Olga Morawczynski. 2010. ICT expansion and the digital divide in democratic freedoms: An analysis of the impact of ICT expansion, education and ICT filtering on democracy. Telematics and Informatics. 27(1): 21-31. Stiglitz, Joseph. 1999. On liberty, the right to know, and public discourse: The role of transparency in public life. Oxford Amnesty Lecture at Oxford University, United Kingdom.]] Access to information also empowers marginalized groups and those living in poverty by giving them the ability to more fully participate in society and providing them with knowledge that can be used for economic gain.[[Bandyopadhyay, Sanghamitra. 2009. Knowledge-based economic development: Mass media dn the weightless economy. Discussion paper no. 74. Distributional Analysis Research Programme, STICERD. London: London School of Economics and Political Science. Deane, James. 2008. Why the media matters: The relevance of the media to tackling global poverty. In M. Harvey (Ed.), Section 1 of Media Matters: Perspectives on Advancing Governance and Development from the Global Forum for Media Development (pp. 35-44). Internews Europe. Kenny, Charles. 2002. Information and communication technologies for direct poverty alleviation: Costs and benefits. Development Policy Review. 20(2): 141-157. Norris, Pippa and Dieter Zinnbauer. 2002. Giving voice to the voiceless: Good governance, human development & mass communications. Background paper for the UNDP Human Development Report, New York: United Nations Development Programme. Sen, Amartya. 1999. Development as Freedom. Oxford: Oxford University Press. Shirazi, Farid. 2010. The emancipatory role of information and communication technology: A case study of internet content filtering within Iran. Journal of Information, Communication and Ethics in Society. 8(1): 57-84. United Nations Economic and Social Commission for Asia and the Pacific. 2000. Urban poverty alleviation. Paper presented at the Regional High-level Meeting in preparation for Instanbul+5 for Asia and the Pacific: Hangzhou, China. United Nations Educational, Scientific, and Cultural Organization. 2006. Presentation paper: Media, development, and poverty eradication. Paper presented at World Press Freedom Day: Sri Lanka.]] Internet shutdowns are harmful as they not only restrict the ability of civil society to engage in political participation and government oversight, but also restrict market access and cost economies billions of dollars each year.[[NetBlocks 2020. Internet cut in Ethiopia amid unrest following killing of singer. NetBlocks Mapping Net Freedom. https://netblocks.org/reports/internet-cut-in-ethiopia-amid-unrestfollowing-killing-of-singer-pA25Z28b. Woodhams, S. & Migliano, S. 2020. The Global Cost of Internet Shutdowns in 2019. Top10VPN.com. Fletcher, Terry, & Hayes-Birchler, Andria. 2020. Comparing Measures of Internet Censorship: Analyzing the Tradeoffs between Expert Analysis and Remote Measurement. Proceedings of 2020 Data for Policy Conference. http://doi.org/10.5281/zenodo.3967398. Raveendran, N., & Leberknight, C.S. 2018. Internet Censorship and Economic Impacts: A Case Study of Internet Outages in India. Proceedings of the Twenty-fourth Americas Conference on Information Systems. West, D.M. 2016. Internet Shutdowns cost countries $2.4 billion last year. Center for Technology Innovation at Brookings.]]

Sources and Indicator Institution Methodologies

-

Reports without Borders’ (RSF) World Press Freedom Index, https://rsf.org/en/ranking/2020. Questions regarding this indicator may be directed to index@rsf.org or +33 1 44 83 84 65

World Press Freedom Index methodology: RSF compiles its data by pooling experts’ responses to 87 questions related to pluralism, media independence, media environment and self-censorship, legislative framework, transparency, and the quality of the infrastructure that supports the production of news and information. This qualitative analysis is combined with quantitative data on abuses and acts of violence against journalists during the period evaluated.

- Centre for Law and Democracy and Access Info’s Right to Information Index, http://www.rti-rating.org/. Questions regarding this indicator may be directed to Toby Mendel at toby@law-democracy.org or +1 (902) 431-3688.

Right to Information Methodology: In this dataset, a freedom of information law is rated based on 61 indicators. RTI includes any country with a freedom of information law on the books.

- Access Now’s #KeepItOn Shutdown Tracker Optimization Project, https://www.accessnow.org/keepiton/. Questions regarding this indicator may be directed to Peter Micek at peter@accessnow.org or +1 (888) 414-0100.

Access Now Methodology: Countries are assigned one point for every day of internet or social media shutdown/throttling up to 9 days. Shutdowns listed as ongoing are assumed to last until the end of the year. Shutdowns that last less than one day are counted as one day. Shutdowns with no end date are assumed to only last one day. If no duration is listed, but a start and end date are listed, a duration is calculated. Non-government shutdowns and non-government throttlings are excluded.

MCC Methodology

MCC FOI Score = (Press) – (FOIA in place) + (Access Now)

This indicator uses a country’s score on RSF’s World Press Freedom Index (Press) as the base. In FY22, MCC uses RSF’s 2021 World Press Freedom Index, which covers events in 2020. A country’s base score may improve based on data from the Global Right to Information Rating. In FY21, MCC uses Centre for Law and Democracy / Access Info Europe’s Global Right to Information Rating (RTI) from 2020. A country’s score is improved by 4 points if they have a Freedom of Information law enacted. Data from Access Now is used to penalize some countries’ base scores. A country’s score is penalized 1 point for each day in the last calendar year (2020) of internet or social media shutdown/throttling, for a total penalty of up to 9 points. For FY21, MCC uses Access Now data from the 2020 #KeepItOn Shutdown Tracker Optimization Project report. On this index, lower is better.

Note regarding construction of missing data: Prior to FY20, MCC utilized Freedom House’s Freedom of the Press scores for its Press component. In 2018, however, Freedom House stopped publishing Freedom of the Press, and MCC selected RSF’s World Press Freedom Index as a replacement. Both indices measure similar concepts on an identical scale (0-100, with lower scores being better). However, because MCC is using a different indicator for Press in FY21, current year data on MCC’s scorecard is not comparable to data found on prior year MCC scorecards.

In addition, the RSF index does not report data for all countries that had data reported by Freedom House, As such, MCC is using the most recent Freedom House “Freedom of the Press 2017” data for the five countries that had Freedom House data, but that are missing RSF data. Although RSF uses the same 0-100 scale for its data, the distribution of RSF country scores sits systematically lower on the scale than does Freedom House’s. To account for this mismatch, MCC normalizes Freedom House scores for the five countries in the following manner:

- MCC identifies each missing country’s percentile rank in the Freedom House global dataset, and then finds the score that would be at the corresponding percentile in the global RSF dataset (using the method of linear interpolation equivalent to the method used by Microsoft Excel in the function Percentile.Inc), and assigns that score to the country.

- Once this matching has been completed for each of the missing countries, and these normalized scores are added to the global RSF dataset, MCC then uses these scores as “Press” in the above equation to calculate the Freedom of Information scores and then percentile ranks for each income group.

- For example, Solomon Islands has a Freedom House score of 27 in 2017, which puts in at the 76th percentile in the global Freedom House dataset. The score at the 76th percentile of the global RSF dataset used in FY21 was 23.77. Therefore, Solomon Island’s normalized Press score was 23.77 for FY21.

Investing in People Category

The indicators in this category measure investments in people by assessing the extent to which governments are promoting broad-based primary education, strengthening capacity to provide quality public health, increasing child health, and promoting the protection of biodiversity.

Immunization Rates Indicator

This indicator measures a government’s commitment to providing essential public health services and reducing child mortality.

Relationship to Growth and Poverty Reduction