Context

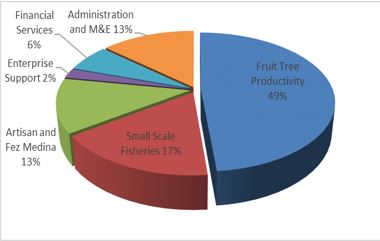

The MCC compact with Morocco was a five-year investment (2008-2013) of $666.4 million in five projects: Fruit Tree Productivity, Small Scale Fisheries, Artisan and Fez Medina, Financial Services, and Enterprise Support.

The $42.8 million Financial Services Project (FSP) represented 6% of the total compact and aimed to increase financial services to microenterprises in Morocco, by addressing the major constraints to the development of a deeper, broader and more market-oriented financial sector.

The Project’s three activities were structured as follows:

- Access to Funds for Microfinance: A subordinated loan of $30.7 million to Jaïda increased funds available for lending to microcredit associations not only through the subordinated loan itself, but also by allowing Jaïda to leverage the subordinated debt (as quasi-capital) and borrow additional funds from other commercial sources. It was assumed that banks, for example, would be more willing to lend to a well-capitalized entity such as Jaida, than directly to an AMC, thereby increasing the amount of total funding available to the AMC sector as a whole, particularly in times of economic uncertainty. Jaïda was able to make available its blended funds to AMCs according to market conditions and general policies of credit risk and eligibility criteria. Towards the end of the Compact, another $5 million was reallocated to this activity to finance a pilot loan project to provide loans to very small enterprises through AMCs. In addition, APP re-disbursed as an additional loan tranche the $3 million that Jaïda had paid in interest during the Compact. Finally, this activity had a $700,000 budget to provide training to 3,000 AMC loan officers on environmental and social issues.

- New Financial Product Development: With a $4.4 million budget, this activity supported an analysis of the regulatory and operational conditions for the institutional transformation of AMCs into other types of institutions, as well as technical assistance to microcredit associations to expand their scope and prepare for the new, more competitive environment of the transforming microfinance sector. Several AMC’s, for example, were laying the early groundwork to become deposit-taking institutions which would require new product offerings but also would entail more robust systems to face off against more rigorous regulatory oversight.

- Improvement of Operating Efficiency and Transparency: This Activity had a total budget of $7.7 million and included four sub-activities:

- Mobile Branches provided financial support to AMCs by acquiring vehicles and converting them into mobile bank branches to provide microcredit in remote areas;

- Technology Facility provided grants to allow AMCs to implement innovative technologies;

- Credit Bureau Preparation helped smaller AMCs purchase computer systems and implement management information systems that would allow them to link with the Central Bank’s credit information bureau; and

- Rating Fund subsidized financial and social ratings for AMCs, evaluating their operations and providing information to potential funders.

Program Logic

The Financial Service Project aimed to improve the financial services available to Moroccan microenterprises by improving market stability and overcoming constraints inhibiting the expansion of the microfinance sector. The Project provided funds in the form of a subordinated loan to Jaïda, a non-bank financial institution, to increase its lending to the microcredit sector. In addition, the legal framework underlying microcredit associations was revised to allow Microcredit Associations (AMCs) to diversify the products and services they provide to their customers, such as savings products. Finally, the project provided support to improve the efficiency and transparency of the microcredit sector, reducing the costs and improving the quality of microenterprise loans in the long term. The program logic is as follows:

| Inputs | Outputs | Immediate Outcomes | Intermediate Outcomes | Ultimate Impact | ||||

| MCC funding used to: |

|

|

| |||||

|

|

|

|

| ||||

|

|

|

| |||||

|

|

|

| |||||

|

|

|

|

| ||||

|

|

|

|

| |||||

There were several key assumptions underlying the Financial Services Support project logic during the design of the Compact:

- The microcredit sector faced constraints that inhibited its growth and expansion, namely the legal framework, access to funds, and the transparency and operating efficiency of AMCs. Prior to the inception of Jaïda, AMCs were largely dependent on donor funding and, to a lesser extent, bank loans.

- Support of increased funding and, thereby, lending would lead to economic growth of the sector.

- The positive trend of the microcredit growth shown before 2008 would continue and even be boosted by increased access to funds.

- Once they receive appropriate technical assistance and the legal framework revised, AMCs would be ready to transform into higher order financial institutions, a status that would allow them to collect funds in a more flexible way and provide diversified services to their clients.

Measuring Results

MCC uses multiple sources to measure results. Monitoring data is used during compact implementation. Independent evaluations are generally completed post-compact. Monitoring data is typically generated by the program implementers, and specifically covers the program participants who received treatment through the compact. MCC conducts performance evaluations to assess whether the program was adequately designed to meet the needs of the program beneficiaries and how the program was implemented. This particular performance evaluation used the following criteria to assess the program activities: coherence, efficiency, effectiveness, applicability, and durability.

Monitoring Results

The following table summarizes performance on output and outcome indicators specific to the evaluated program.

|

| Level | Actual Achieved | Target | Percent Complete |

| Access to Funds Indicators | ||||

| Value of loan disbursements to Jaïda[[Per updated post-Compact information, $30 million was disbursed in total]] | Output | $30 million | $25 million | 120% |

| Number of loan officers trained on social and environmental norms | Output | 2311 | 3000 | 77% |

| Value of loan agreements between Micro credit associations and Jaïda[[Per updated post-Compact information, 694 million DH in total agreements were signed]] | Outcome | 694 million DH | 983 million DH | 59% |

| New Financial Products Indicators | ||||

| Number of AMCs with a grant from the TA/Transformation Fund | Output | 12 | 12 | 100% |

| Financial self-sufficiency ratio | Outcome | 115 % | 109% | 160% |

| Portfolio at risk at 30 days (for all AMCs within the entire microfinance sector) | Outcome | 5.7% | 4.5% | 21% |

| Improving Operational Efficiency and Transparency Indicators | ||||

| Number of mobile branches acquired | Output | 150 | 100 | 150% |

| Number of AMCs with a grant from the Technology Facility | Output | 4 | 11 | 36% |

| Number of financial ratings carried out | Output | 8 | 8 | 100% |

| Number of social ratings carried out | Output | 5 | 7 | 71% |

| Number of mobile branches clients | Outcome | 3350 | 55 000 | 6% |

| Proportion of AMCs who report to the credit bureau | Outcome | 31% | 100% | 31% |

| Proportion of AMCs who request information from the credit bureau | Outcome | 38% | 100% | 38% |

The average completion rate of output and outcome targets is 74.5 percent; and in 4 of the 13 indicators, targets were met or exceeded.

Evaluation Questions

The evaluation was designed to answer the following questions:

- The microcredit sector had been in a serious crisis since 2008. Did the subordinated loan to Jaïda allow the Moroccan microfinance sector to overcome this crisis? Did the project improve the operational efficiency and transparency of AMCs?

- Did the project improve access to microfinance services, especially in remote areas? What is the impact on the income of clients who had access to microcredit through mobile branches acquired by the project for remote areas?

- Are the social and environment standards integrated into the microcredit sector as a result of the training of credit officers?

- To what extent did the technical assistance for transformation offered to AMCs allow them to be prepared for transformation?

- What are the perceptible outcomes and impacts of the project?

Evaluation Results

During the preparation phase of the project, the microcredit sector was expanding rapidly and this positive trend was expected to continue. In 2007, a crisis began, followed by a period of significant growth in past-due loans, microenterprises’ increasing cross-indebtedness to multiple AMCs, and a significant rise in consumer credit. The 2008-2012 period saw the efforts of the AMCs largely focus on improving their own portfolios, debt collection, the establishment of more conservative credit policies, and the adoption of risk management measures. These changes influenced the implementation of the Project, which was obliged to adapt to this new context. In the third quarter of 2013, AMCs’ loan portfolios had finally returned to their pre-crisis levels. This evaluation took place in 2013, before the Project closed. Hence, it was still too early to fully assess the impact of the project.

The subordinated loan made to Jaïda helped support the recovery of the microfinance sector. Through the funding provided by MCC, Jaïda provided financing of at least $33 million (including “recycled” interest) to AMCs and therefore maintained their level of activities or helped them free up funds to expand their offer of financial products. In addition, the Loan Agreement clauses led to the introduction of social and environmental standards in the credit lending policies of AMCs. The positive impacts of the loan on Jaïda and the AMCs will be felt for at least 10 years. The APP estimates that 51,000 microenterprises have had access to credit by means of the Jaïda loan and that this number could reach 400,000 over a period of 8 years.

The transformation of large AMCs into higher-order financial institutions will create favorable conditions for the reduction of interest rates on loans and the expansion of financial services offered to microenterprises. The AMCs that choose not to transform will, thanks to FSP support, also be able to reduce their interest rates given that they will become more efficient. The effect on microenterprises will be felt in the medium term.

All of the AMCs have clearly been focused on greater professionalization, efficiency and transparency through technical assistance in very diverse areas. The AMCs are currently better equipped to answer the information requirements for internal management and reporting to the credit information bureau. The results of the first mobile branch client surveys are encouraging, and it is argued that in the medium term, tens of thousands of microenterprises operating in the remote areas served by these branches will have access to financial services. Already, access to credit for the people of 350 rural communities has been improved as a result of the mobile branches.

The quantitative surveys conducted among the customers of mobile agencies in the context of this evaluation identified several promising results regarding the impact of mobile agencies on the income increase of customers in remote areas. According to the survey, 39.6% of customers who obtained credit (March and April 2013) have increased their net annual income by 5000 DH (roughly US$500), which represents an increase of about 50% compared to net income before obtaining the credit.

| Evaluator | North South Consultants Exchange (NSCE) |

| Methodology | Pre-post |

| Evaluation Period | From April 2013 to September 2013 |

| Intermediate Outcome |

- - -Micro-entrepreneurs in many remote areas have more access to microcredit thanks to mobile branches |

| Ultimate Impact |

|

Lessons Learned

- Empowering Project Participants: Involving direct project participants (in this case, the AMCs) in project preparation and design is a good approach to manage risk, improve efficacy, empower the beneficiary and reduce the burden of internal procurement. Under the Transformation/TA and the Technological Innovation sub-activities grant funds were established in which AMCs submitted their own proposals for funding, and a selection panel graded the proposals. Those meeting a minimum score qualified for grants to fund 70 or 80% of the total cost of the project. Because Moroccan AMCs were relatively well-structured, they were provided with guidelines on good procurement practices and allowed to submit proposals to procure their own goods and services for their projects. Once APP’s procurement department had cleared the plans, the AMCs launched their procurements, and they received grant funds in tranches as specified deliverables were submitted and approved by the steering committees which included representatives from APP and the AMCs. All the AMCs were very appreciative of this project structure, which gave them ownership of their projects and gave them the benefit of APP’s assistance in improving their procurement and project management practices. This approach reduced the burden on APP’s procurement department while allowing APP to maintain appropriate oversight of the grant-funded projects.

- Flexibility of Funds: Allowing a sufficient margin for maneuvering (interest rates, reporting, etc...) for entities responsible for administering external funds is a good practice. This was the case for the Jaïda Loan Agreement. The use of grant funds to implement some of the project’s sub-activities provided flexibility, allowing the AMCs to define their own project needs and timelines in the aftermath of the 2007 crisis, while staying within the broad scope of the Compact’s activities.